Is investing in gold profitable?

Gold is a metal that stimulates the imagination. Whether it is the legends of alchemists trying to create gold in their secret laboratories or westerns about the gold rush in the United States, these are just cultural examples of the important role this precious metal plays in life and social consciousness. Wedding rings are made of gold, gold bars act as financial reserves of many countries, and royal insignia are also gold. To this day, gold stimulates the imagination and is an object of desire. It arouses the interest of investors. Is investing in gold profitable?? Is it still a precious metal that has not only cultural and traditional value, but is also a way to safely invest capital? Is it better to treat gold as a main area of investment, or rather as a way to diversify capital? Is it better to invest money in commodity funds and play on indices, or is it better to physically buy the precious metal in bars? investment and store it in a safe place? There are many possibilities and ways.

Is investing in gold worth it – a fresh look at the latest data

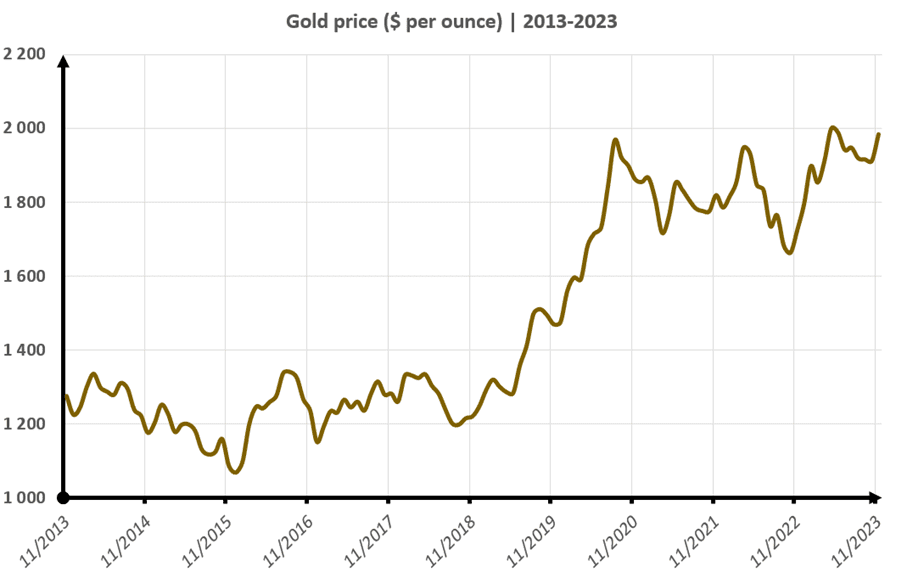

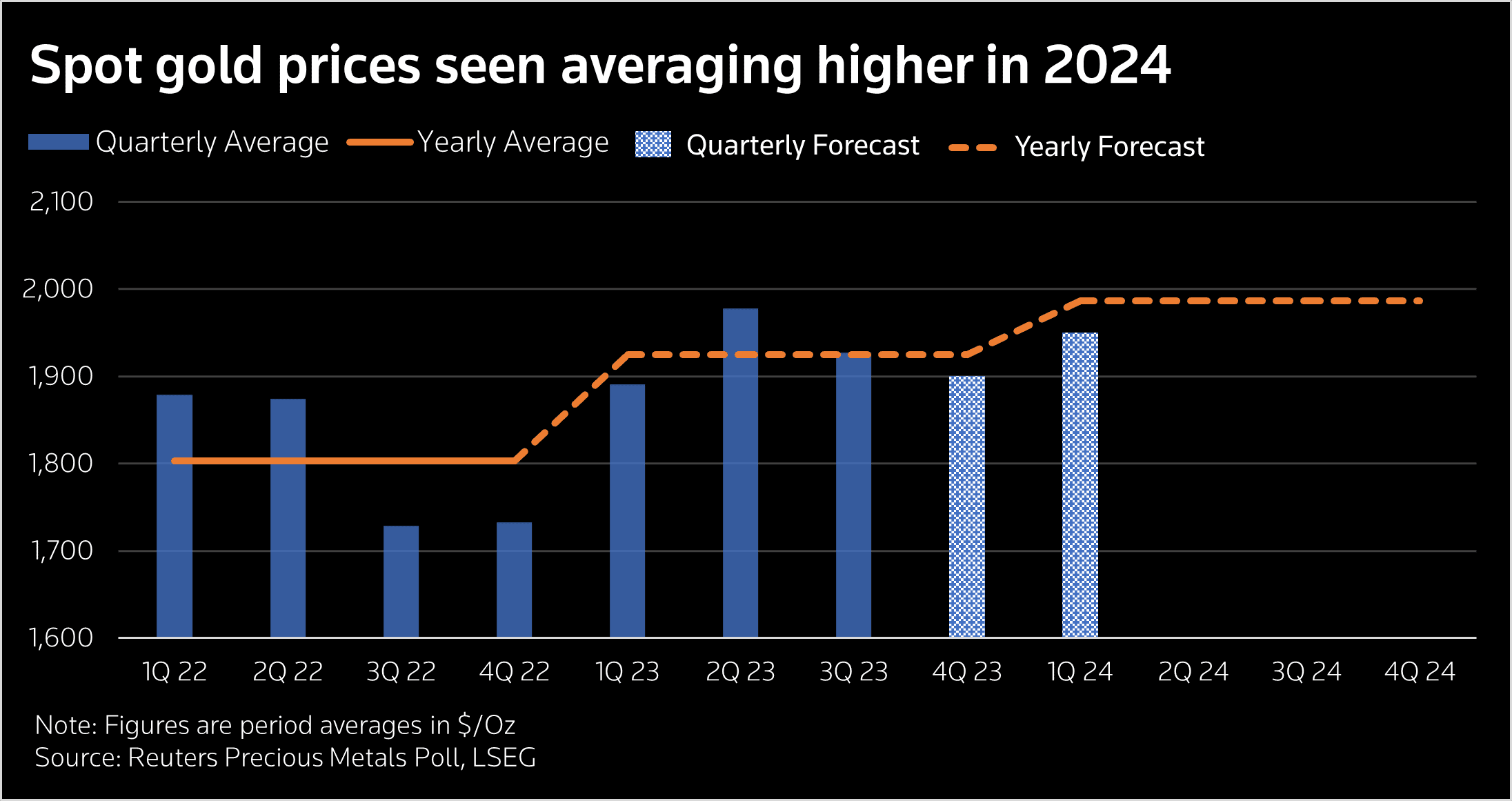

In 2024, the gold market is attracting more and more attention from investors, becoming one of the most fascinating topics in the world of finance. Gold has seen an impressive price increase since the beginning of the year, starting at $2,063.73 per ounce in early January and reaching $2,502.53 by the end of August. That’s a staggering 21.26% increase in just eight months, standing out among other asset classes.

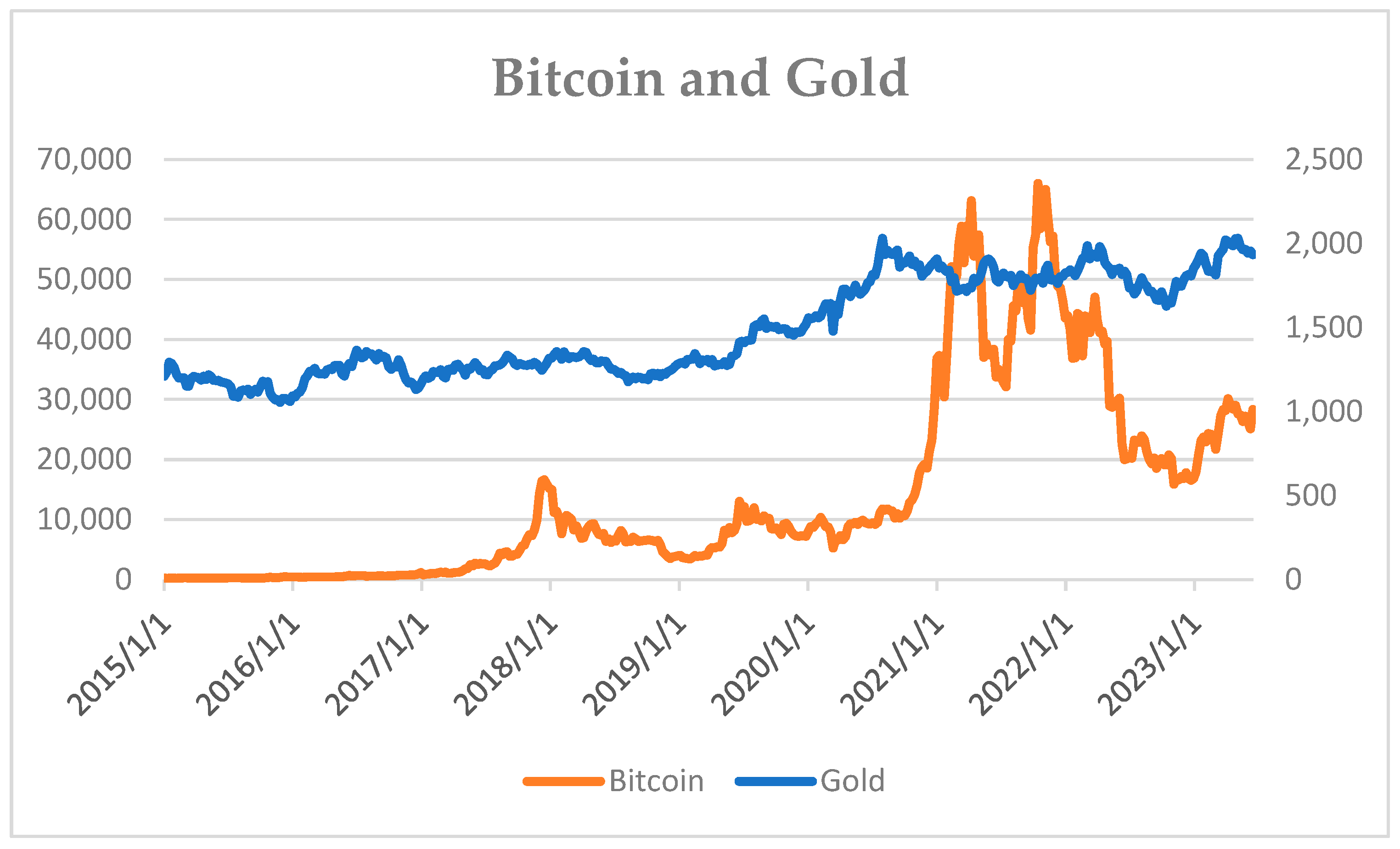

As stock markets like the S&P 500 and Nasdaq post steady, if modest, gains and cryptocurrencies including Bitcoin and Ethereum set new yearly highs, gold is proving its enduring value as a safe haven amid global uncertainty. This explosive growth is supported by several fundamental factors, including changing supply and demand dynamics and monetary policy expectations. So, whether investment is it worth investing in gold? In this context, it is obviously worth having these assets in your investment portfolio.

The price increase is being fueled in part by the increasing difficulty of extracting new gold. This, combined with rising demand from emerging economies and central banks, creates ideal conditions for further price increases.

In addition, expectations of Fed interest rate cuts, which could weaken the dollar and lower bond yields, are further increasing gold’s appeal. In the short term, investors Technicals are observing a resistance level around $191-194 per GLD ETF unit. A breakout of this could open the way for further gains towards $200-205, with a potential long-term target around $220.

Gold, thanks to its role as a hedge against inflation and market volatility, is becoming an essential element of a well-diversified investment portfolio.

While other assets may decline in value in the face of unpredictable geopolitical and economic events, gold offers stability and profit potential. This makes it a unique asset in the broader investment market.

Gold and Bitcoin

In light of the growing popularity cryptocurrencies and rapid growth in the technology sector, gold remains irreplaceable as an anchor of stability in a portfolio. It offers both capital protection and the possibility of profits in the face of upcoming market challenges. When building or transforming an investment portfolio, it is worth betting on the advantage of gold. Palladium and platinum can also be an interesting addition.

How to Invest in Gold? Ways, Markets, Methods

Investing in gold can take many forms. From financial gold market instruments to physical possession of bars and jewelry. Each method has its advantages and disadvantages, so it is important to choose the right approach for your own goals and risk tolerance. As a safe haven, gold is an excellent complement to a diversified investment portfolio. It offers protection against economic turmoil and potential long-term profits.

Is it worth investing in gold when you buy shares of a mining company? Or maybe it would be better to buy a gold bar? Or gold earrings for your wife – here the value is not only the precious metal…

Investing in the Gold Market: Indices, Funds and Mining Companies

- Gold indices

Investing in gold-linked indices, such as Gold ETFs (Exchange-Traded Funds), allows investors to gain exposure to the gold market without owning the metal. This is a great option for those looking for an easy and liquid way to invest in gold.

- Investment funds

Gold and mining funds offer diversified exposure to the gold sector. They are managed by professionals. This reduces the risk of investing in a single asset.

- Shares of mining companies

Buying shares of companies involved in mining the ore can bring significant profits during periods of rising gold prices. However, it must be remembered that such investments are also burdened with risks related to the operations of the companies and the volatility of commodity markets.

Purchase of investment gold bars

- Advantages

Physical possession of gold in the form of bars gives the investor full control over their wealth. Physical gold is easily accessible and can be stored at home, in a bank or in a specialized warehouse. It also protects against inflation and declining values of other assets. Investment bars are a popular way to invest in gold.

- Defects

The storage and security of gold bars involves additional costs, and sales may be less liquid compared to financial instruments. In addition, the purchase price may be higher due to dealers’ margins.

Buying gold jewelry and other gold items

- Investment value

Gold jewelry, in addition to the value of the precious metal itself, may have additional value related to brand, rarity, quality of workmanship and origin. The brand or designer is important. For buyers, it is a way to combine investing in gold with the pleasure of owning beautiful objects.

An interesting option is jewelry auctions at Sotheby’s or Christie’s. You can find real treasures there.

- Collectible and historical value

Gold coins, antiques and jewelry can increase in value over time due to their uniqueness, historical significance and artistic craftsmanship. Collecting such items is not only an investment, but also a passion that can bring satisfaction and profit.

Gold Trivia – Why are its resources limited, where does it come from and why is it so expensive and important?

Gold is a precious metal known for its resistance to corrosion, tarnishing and rust. Its exceptional durability makes it an excellent medium not losing value. It delights with its shine even after thousands of years. Gold not only captivates with its color, but also with its aesthetic charm. For centuries, it has attracted people all over the world and aroused desire, fired up the imagination. From ancient civilizations such as Egypt, where gold was a symbol of power and prestige, to the modern world, where it plays a role in electronics and technology, gold has consistently aroused admiration.

Versatility, value, durability – is investing in gold worth it?

One of the most fascinating aspects of gold is its diverse applications. It is valued in jewelry. It has found its place in electronics, dentistry, and even space technology. With its excellent conductivity and corrosion resistance, it is an ideal material for modern technology. It is worth knowing that gold is chemically inert. This means that it does not react with most other substances, making it extremely versatile and safe in various applications.

Gold is also an important component of many countries’ currency reserves. Central banks hold gold reserves to ensure the stability of their currencies and support their economies. This strategic hedge is crucial to the global economy.

Gold in culture and pop culture

The price and value of gold are influenced not only by objective factors, but also by its perception in culture, its presence in myths, legends or films. The ancient Midas turns everything into gold.

In ancient times, gold was considered a symbol of divinity and power. An example is the golden mask of Agamemnon, discovered in Mycenae in 1876. This ancient relic, dated to around the 13th century BC, is considered one of the most important artifacts associated with the Mycenaean civilization. Its craftsmanship in pure gold not only emphasizes the status of the deceased, but also shows the importance of gold as a material of divine and royal significance. symbolism.

In the Bible, gold is a symbol of sin and infidelity in the form of the golden calf that the Israelites created in Moses’ absence. Gold represented wealth, which was a sign of alienation from Yahweh and turning away from true faith. In this context, gold serves as a material representation of moral failure and betrayal.

Contemporary pop culture also draws heavily on the symbolism of gold, often using it to express wealth, power, and luxury. In literature, film, and art, gold is often portrayed as a symbol of aspiration, greed, and eventual success. Films such as Pascal Plisson’s “Gold” and the classic “Gold of Rum” use gold as a central plot element. This emphasizes its enduring place in the human imagination as an object of desire and timeless value. Chaplin’s “Gold Rush” is a classic in its own right. And the subject of gold prospectors has been a driving subject in numerous Westerns. There are many examples of gold’s cultural role. However, are they the answer to the question of whether investment is it worth investing in gold? They’re certainly a good clue.

Wealth straight from space

Gold is relatively rare in nature. Its presence on Earth is the result of cosmic phenomena, such as neutron star collisions. As a result of these processes, gold was “sent” to Earth by meteorites. Although significant amounts of gold are found in the oceans, its extraction is extremely expensive due to its very low concentration in water. In practice, this means that most of the gold we have comes from difficult-to-extract deposits on the Earth’s surface. And there is not that much of it.

The largest gold nugget, called the Welcome Stranger, discovered in Australia in 1869, was 25.4 cm by 63.5 cm! Such treasures are rare, however. Even today, despite advanced technology, gold mining is difficult, arduous and dangerous. And the resources are dwindling.

Is investing in gold worth it? This precious metal is more than just metal

Gold is more than just a metal – it is a symbol, an investment, and an element of culture and technology. Its fascinating history, diverse uses, and extraordinary durability make it an irreplaceable material in many areas of life. If investment is it worth investing in gold? Certainly yes, given its long-term value and wide application.

Leave a Comment