Is wine a good investment?

In ancient Greece, humanoid-shaped machines stood on the streets, pouring some delicious, or not so, drink and water to those who were thirsty for coins. The Greek inventor Philo of Byzantium around 220 B.C. he knew the wine had potential. His robot is not only a perfect example of the genius of Greek inventors, but also one of the first investments in wine. In 2024, you don’t have to be an inventor to start your own vineyard, purchase an existing one, buy a bottle of a unique drink or shares in a company specializing in wine. The question should be no Is wine a good investment?, or rather, how to invest in wine to be successful.

Is wine a good investment – market analysis and prospects

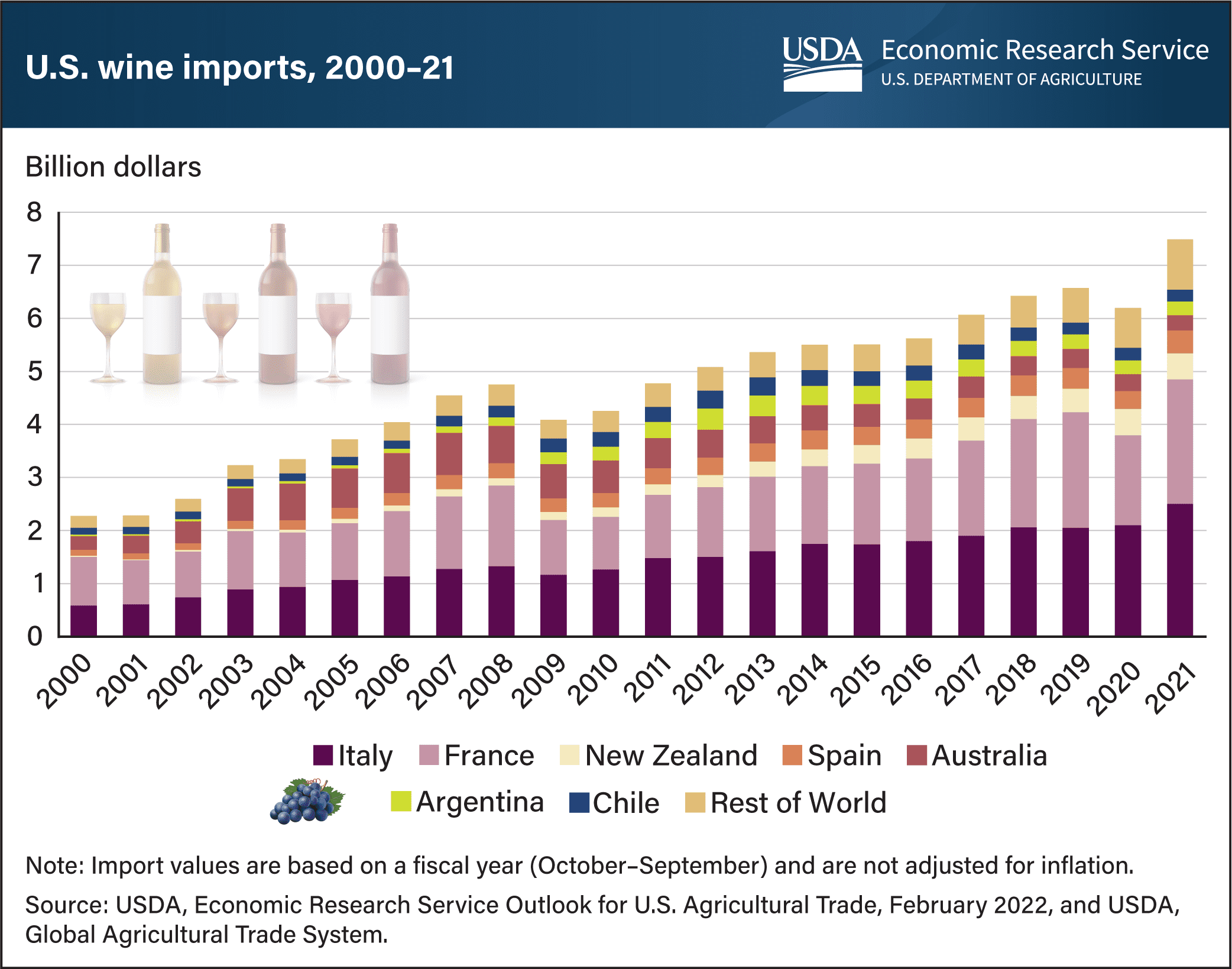

Investing in wine has long been perceived as an alternative form of investment that can bring significant profits. The choice of investment is not subject to fashion or temporary trends. In 2024, the wine investment market continues to develop, and its dynamics indicate the growing interest of both individual investors and financial institutions. Like the whiskey market, it is an interesting area for investors and for portfolio diversification.

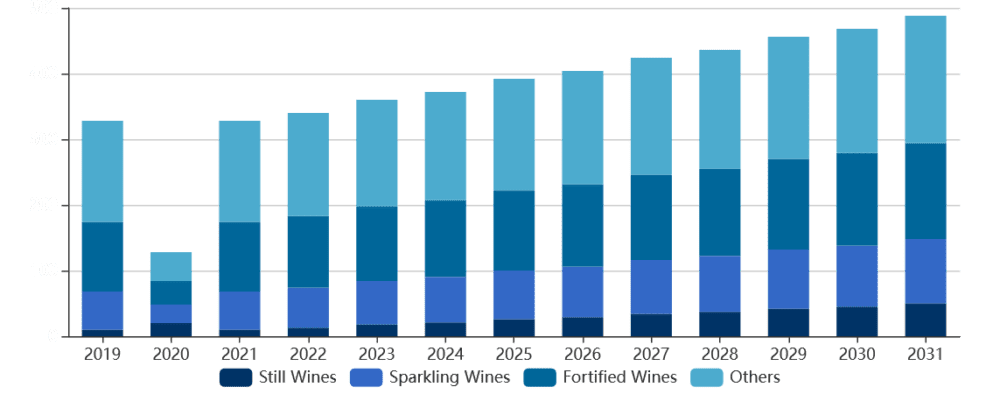

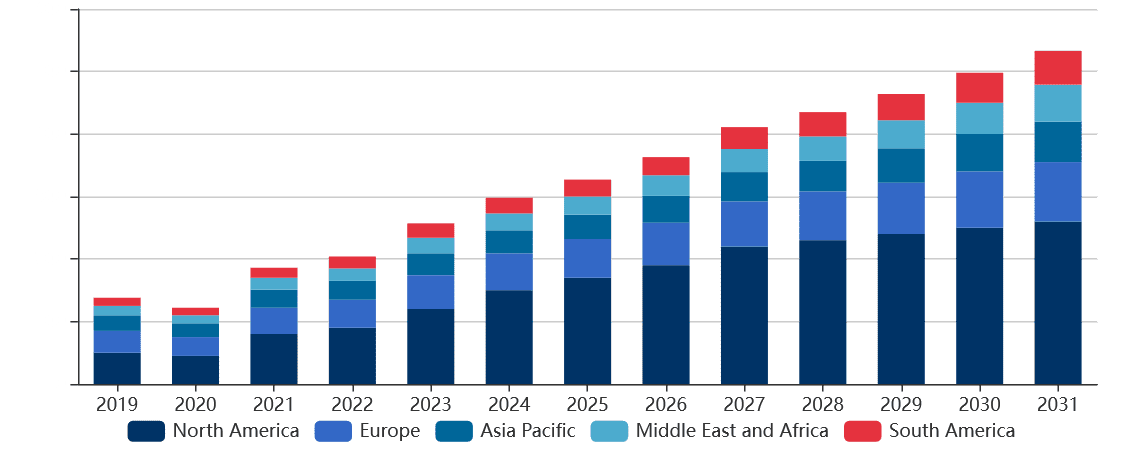

According to the latest Global Wine Market Report 2024, the wine market is expected to reach USD 652.31 billion by 2030, growing at a CAGR of 6.37% over the period 2024-2030. Growing demand for high-quality wines, especially in developing countries, and increasing interest in collectible wines are contributing to this promising development. As in whiskey. So when we wonder whether wine is a good investment, just look at reports and charts.

Factors driving the market

- Increased wine consumption: More and more consumers around the world are choosing wine as their preferred alcoholic beverage, increasing demand for various types of wine, including premium wines.

- Growth of the collectible wine segment: Limited edition and aged wines increase in value over the years, making them an attractive investment asset.

- Portfolio diversification: Investing in wine is considered a way to diversify your investment portfolio, reducing the risk associated with more traditional investments.

Challenges and limitations

Despite the growing popularity of investing in wine, there are also some challenges and limitations that may affect this market:

- Market Regulations: Strict regulations on the sale and distribution of alcohol in various countries may hamper the development of the market.

- Variable Consumer Preferences: Consumer preferences may change, which may affect the value of certain types of wine.

- Impact of Climate Change: Climate change may affect wine production, which may reduce the availability of some vintages.

Future perspectives

Perspectives investing into wine in 2024 look promising. The wine investment market continues to develop, offering new opportunities for investors. Key segments such as red wines and sparkling wines are expected to continue growing. Furthermore, the development of technologies such as blockchain can provide greater transparency and security of wine investments.

Recommendations for investors

- Market analysis: Investors should carefully analyze market trends and forecasts to make informed investment decisions.

- Investment diversification: It is important to invest in different types of wine from different regions to reduce risk.

- Long-term approach: Investing in wine often requires a long-term approach, as wine values can increase over time.

Investing in wine in 2024 is an attractive option for those who are looking for alternative forms of investment. A growing market, growing wine consumption and the potential to increase the value of collector wines make this form of investment promising. However, like any investment, it requires appropriate preparation and analysis to maximize profits and minimize risk.

How to invest in wine?

The wine auction, which took place on March 20 under the aegis of the British auction house Christie’s, was not only unique in terms of the value of the lots sold, but also showed dynamic changes in the way wine is traded around the world. Despite an almost empty auction room, with only a dozen or so observers following the bidding, the auction raised a staggering £1.3 million. Particularly noteworthy was a lot of 12 bottles of Domaine de la Romanée-Conti from 1988, which sold for an impressive £232,750 ($305,135).

What was particularly interesting and surprising was that most of the bids came from remote bidders spread across five continents. The technology allowed for live conversion of offers in different currencies, making it easier for collectors from all over the world to participate. Tim Triptree, international director at Christie’s wine department, noted that as many as 41% of the auction house’s new customers are attracted to the online platform, demonstrating the changing dynamics of the wine market.

This auction not only confirmed the dominance of online bidders, but also showed that the younger generation – 61% of buyers were between the ages of 35 and 55 – made up a significant portion of the market. It is these young people who often choose to shop at auctions, looking for unique opportunities and collectible rarities. Such events not only reflect changing trends in the wine trade, but also demonstrate the growing global appeal of collectible wine bottles as an investment.

Instead of wondering whether wine is a good investment, it is worth analyzing how to invest in it. The above situation shows one of the options, i.e. purchasing a unique bottle and creating a collection of wines from the best vineyards and vintages. This way of investing money usually takes place at auctions and adds a lot of prestige to the buyer. This is also demonstrated by auctions of famous whiskies, among which legendary unique items reach exorbitant prices The Macallan.

Not only unique items

Investing in wine is not just about auctions of unique specimens. This is really an option for the few. However, business offers many more possibilities of investing money in wine. The first and easiest is to buy shares. Gallo, Concha y Toro or Yellow Tail are powerful companies. The first has hectares of vineyards and produces over 40% of the famous Californian fault. Interestingly, these powerful companies do not specialize in the production of exclusive wines. Their products are largely sold in stores and supermarkets and are a daily addition to dinner for millions of people around the world. Good quality and affordable.

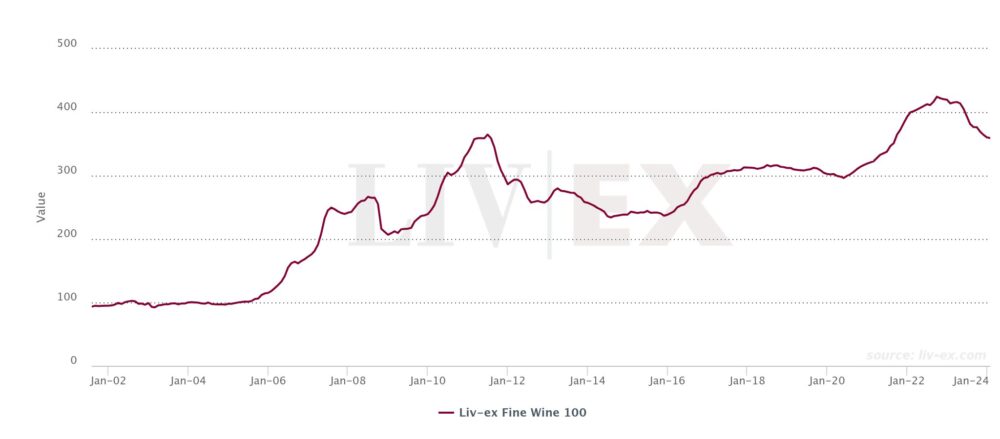

However, recently, according to Liv-ex, wine indices have seen slight declines and corrections. Although the trend is clearly upward. The fine wine market has shown mixed results at the beginning of 2024, which presents both challenges and opportunities for investors. The Liv-ex Fine Wine 100 index fell 0.3% in January, indicating milder declines compared to previous months. In contrast, the broader Liv-ex Fine Wine 1000 index saw a larger decline of 2.2%, with the biggest losses in wines from the Rhône region.

Digitization and online auctions attract younger buyers aged 35-55, which is changing the demographics of the market. Regular updates of the Liv-ex indexes, replacing less popular wines with more actively traded ones, ensure their relevance and accuracy. The fine wine market remains dynamic, offering both risks and opportunities for investors. The market is also interesting non-alcoholic drinks.

Or maybe your own vineyard

An option for enthusiasts is to buy their own vineyard. Greek, Chilean and Italian vineyards are beautiful places, located in beautiful Arcadian areas. If wine is your true passion, it is worth considering buying or starting your own vineyard. It is a labor-intensive, time-consuming and involving investment.

But producing and selling wine can give a lot of satisfaction – not to mention income.

Wine trade business

Due to the growing interest in wine, it is worth considering not only wine production or the purchase of shares, but also investments related to distribution and sales. Luxury wine shops and small local shops are a response to the need of many people to buy wine, taste it and have access to bottles with different prices, tastes and countries of origin.

With such possibilities, it is difficult to doubt whether wine is a good investment. This is almost a no-brainer.

The most expensive wines in the world

As a curiosity rather than an investment option, it is worth getting to know the most famous and most expensive wines in the world.

After all, they attract the attention of not only connoisseurs, but also investors and collectors. Unique items from auction stimulating the imagination. Here are three of the most famous and expensive wines that have gained fame thanks to their prices and unique stories:

Screaming Eagle 1992 – This California wine, from Oakville in the Napa Valley, was produced in 1986. This wine achieved a record price at a charity auction, where Chase Bailey paid $80,000 for it. Its prestige and rarity make it one of the most sought-after wines in the world.

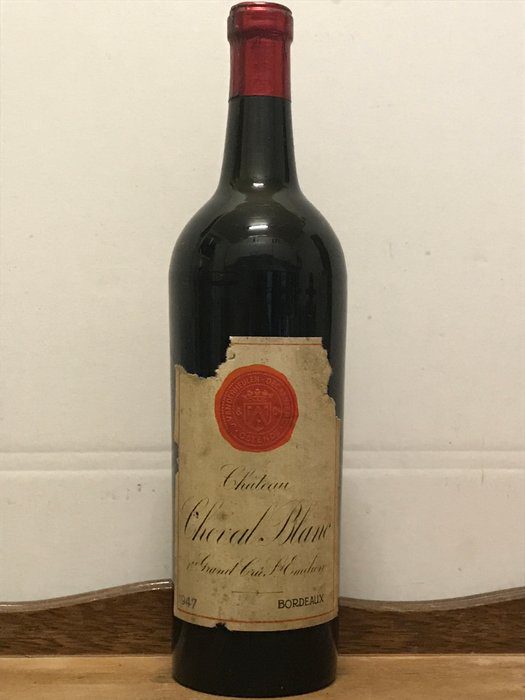

Cheval Blanc 1947 – This exclusive dry wine from the Bordeaux region is considered one of the best wines of all time.

One bottle of this extraordinary drink reaches the price of 135,000 dollars. The 1947 Cheval Blanc is appreciated not only for its exceptional taste, but also for its historic vintage.

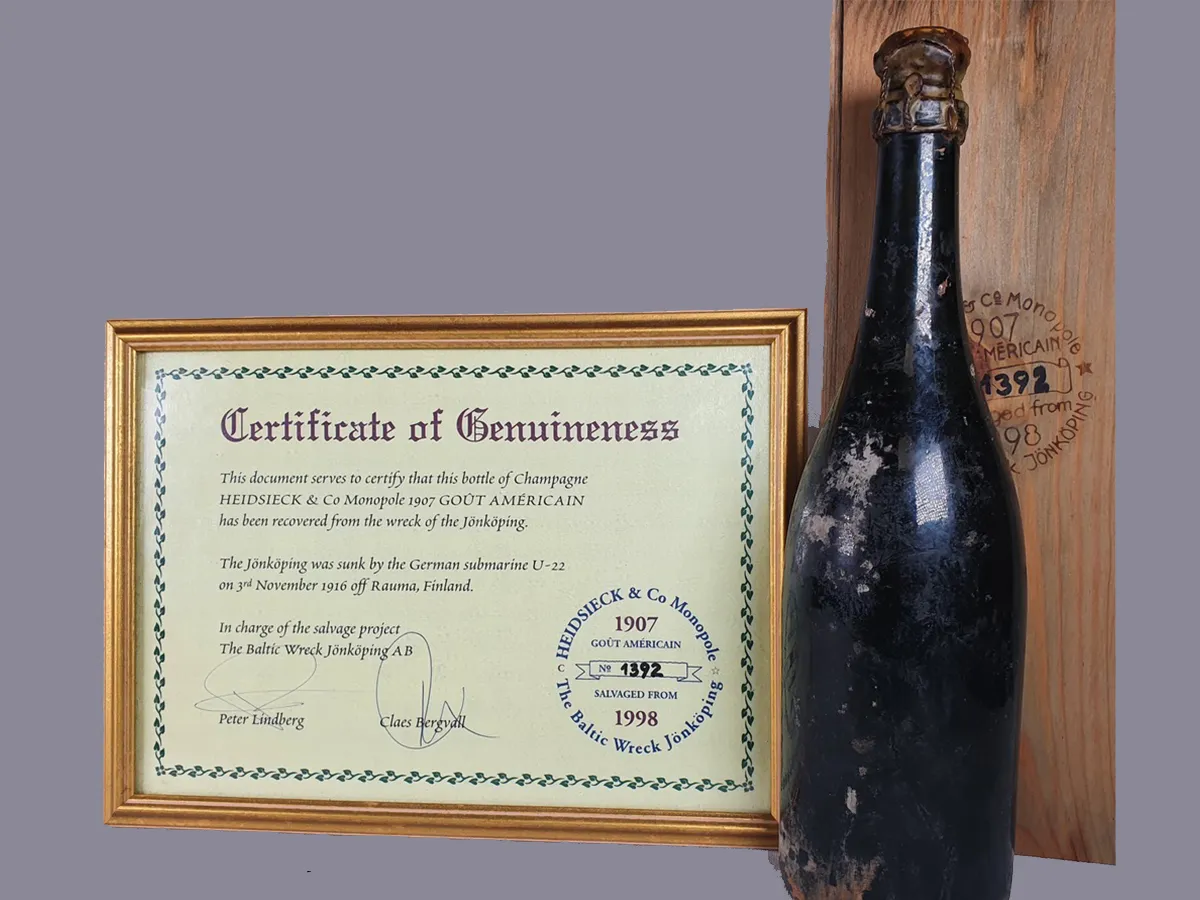

Heidsieck Champagne 1907 – This unique sparkling wine was produced at the beginning of the 20th century at the request of the tsar’s family. A bottle of this champagne was found in a shipwreck in 1997, which added even more value to it.

The history and age of this drink make its price reach 275,000 dollars, making it one of the most expensive wines in the world.

These exceptional wines, thanks to their unique stories and excellent quality, command extraordinary prices that underline their prestige and importance in the world of wine.

Is wine a good investment? There are so many options for investing money in wine that it is an option to consider for both smaller and larger investors. Whether it’s investing in stock exchange indices or purchasing unique bottles of wine. It is definitely worth considering this option. And a temporary drop in indexes may be the perfect time to enter the market.

Leave a Comment