Is it worth investing in whiskey?

Whiskey is an alcohol with a long tradition of production. The first mentions of the amber “water of life” come from ancient times. The tradition of creating interesting-tasting, aromatic and beautiful-colored drinks dominates in Scotland and Ireland. There, each distillery has its own unique style and character. The products of some of them taste excellent. Some have achieved such prestige that the prices of individual bottles are comparable to the prices of exclusive cars. Is it worth investing in whiskey? But is this a passing fashion and bottles of amber alcohol, now worth a fortune, will soon be worthless?

Is it worth investing in whiskey – fashion or timeless value?

Auctions, past and planned, at Sotheby’s London, where recently the collectible, unique and unique The Macallan 1926 60 YO Valerio Adami was sold for an exorbitant price of PLN 10.85 million, perfectly demonstrate that whiskey is not an ordinary alcohol. Between store-bought Ballentain and unique single malts from unique barrels, traditional distilleries or unique series there is a big leap.

Is it worth investing in whiskey – definitely yes, although as with any investment, you first need to know the market well. It’s worth reviewing a few tips to get started.

- Increase in value: Over the last decade, prices for rare and unique bottles of whiskey have increased significantly, making it an attractive form of investment.

- Value Stability: Whiskey is considered an asset with low correlation to traditional financial markets, which can help diversify your investment portfolio.

- Global market: Interest in whiskey is growing around the world, especially in Asian countries, which ensures constant demand and a global market for investors.

- Tradition and history: Whiskey has a rich history and tradition, which adds cultural and emotional value to it and can also attract collectors and passionate investors.

- Limited production: Many prestige whiskeys are produced in limited quantities, making them particularly attractive to investors seeking rarity and uniqueness.

- Development of the investment market: The emergence of specialized investment funds and indices tracking the whiskey market proves the professionalization of this sector and the opening of new opportunities for investors.

- Inflation Hedge: Some believe that rare and prized whiskey bottles can act as a hedge against inflation, retaining their value over the long term.

- Potential of technological applications: The development of technologies such as blockchain can contribute to increasing the transparency and authenticity of individual whiskey bottles.

Investing in whiskey

In the world of investments, where traditional assets such as real estate, stocks and bonds dominate, a new, exceptionally attractive player appears: whiskey. What was once associated mainly with the pleasure of tasting has now become an object of interest for wealthy investors looking for new ways to diversify their portfolio. Unique bottles of alcohol are increasingly auctioned and, after purchase, they are stored in the new owners’ safes. The highest prices are achieved by single malt and single barrel drinks, such as the previously mentioned Macallan from 1926. It was bottled after 60 years of maturation, with each bottle having its own, unique label designed and created by a renowned artist. The previous auction record was broken by another bottle from the same distillery, Macallan Fine&Rare 1926.

It’s hard to say what this whiskey tastes like. However, legend has it that one of the owners, after bidding on an extremely expensive Macallan from the same series, simply opened the bottle and drank the whiskey. This connoisseur probably served his priceless drink in unique glass. However, this approach has little to do with investing.

Whiskey market dynamics

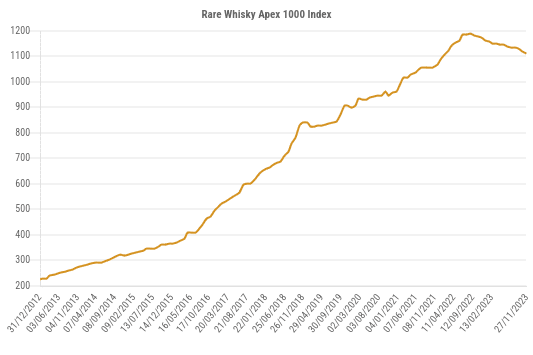

Analyzing the last decade, one can notice an exceptional increase in the value of whiskey as an investment asset. Indexes such as the Knight Frank Rare Whiskey 100 Index have seen gains of 582% over a 10-year period. These are values that attract the attention of every investor looking for opportunities on the market. Raw numbers therefore perfectly answer the question of whether it is worth investing in whiskey.

What drives this dynamic

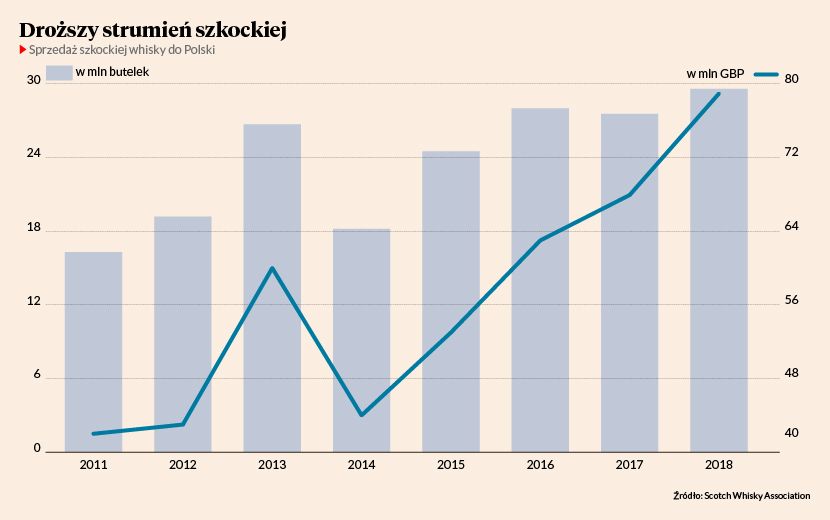

The increasing popularity of whiskey in Asian countries and the constant interest in Europe and the USA result in a constant increase in demand. Many whiskey producers, although increasing their production, still have problems adapting to global demand. It is worth emphasizing that distilleries also strive to ensure that the whiskey they produce and bottle is of exceptional value. Therefore, it is a completely different philosophy than, for example, production Jack Daniels’ and.

From time to time, collector’s editions appear on the market. They are created in cooperation with artists and famous photographers – Macallan is once again a leader here.

Diageo Group has undertaken another innovative strategy. Every year around the holidays, he releases a series of six or seven historic bottles. They come from unique barrels, often legendary, but no longer existing distilleries. This is a beautifully published collection with original labels created by renowned artists. It is therefore worth considering one of these bottles not only as an investment, but also as a… a gift.

For example, a bottle of cask-strength single malt from Pittyvaich – a now demolished distillery whose barrels were bought by Diageo in 2020 – has gained a lot. The situation is similar with bottles from the same collection from the now defunct Brora distillery, of which less than 3,000 bottles were released, and the price of each of them has more than doubled significantly since 2016. Is it worth investing in whiskey? This example shows that it is worth it, a collector’s bottle can also be a gift for a young couple.

The importance of data and analysis

In the world of investing, a thorough understanding of the market is key. Rare Whiskey 101 has become a renowned source of information, providing detailed analysis and forecasts on prices and trends. Such metrics provide investors with the tools to make informed decisions, understand the value of individual whiskeys and their potential growth.

New forms of investing

This phenomenon inspired the creation of innovative investment solutions, such as the Single Malt Fund. They allow investors to collectively invest in rare whiskeys. They open the door to the world of premium alcohol even for those with less capital.

Risk and responsibility

Like any investment, whiskey is not risk-free. There is a risk of counterfeiting and changes in consumption that may affect the value of individual bottles. Therefore, it is crucial to invest carefully, based on solid data and analyses.

The whiskey market has become not only a place for connoisseurs, but also an attractive arena for investors. Understanding its dynamics, using reliable sources of information and making informed investment decisions are the basics.

Investing in whiskey is not only a chance to make profits. It is also an opportunity to learn about the history, tradition and culture related to this unique drink. For many, it is a way to combine passion with business, while creating innovative and profitable investment strategies.

A short guide on whether it is worth investing in whiskey and how to invest in it

Not everyone can afford to buy a bottle of alcohol for PLN 10 million. However, the whiskey market is not only about unique Macallans or Legendary Yamazaki from the Japanese Suntory distillery. As the example of Diageo’s Special Relase series clearly shows, every year you can buy a bottle of whiskey on the market for around two or three thousand. It is often a unique drink, from non-existent distilleries, barrel strength with an original label, which will increase in value many times over after a few years of storage. This is perfect gift and capital investment. However, to invest in alcohol, as in anything else, you need to know the market and its specifics.

Here are some practical tips for a beginner investor

- Education and market understanding::

- Before investing in whiskey, it is worth learning more about the different types. It’s a good idea to look at the history, regions of production, and potential factors affecting value.

- Determining the budget::

- Decide how much you are willing to invest. Remember that investing in whiskey, especially rarer and older bottles, can require significant resources.

- Start of the collection::

- Start by purchasing more accessible and affordable bottles to understand the market dynamics and gain experience.

- Primary market vs. secondary::

- Bottles can be purchased both on the primary market (directly from the distillery) and on the secondary market (at auctions, from dealers). Prices may vary depending on the source of purchase.

- Storage::

- Whiskey is best stored in a dark place, away from sources of heat and direct sunlight. Appropriate storage conditions will ensure that the quality of the drink is maintained.

- Market monitoring::

- Regularly monitor prices on the secondary market, participate in auctions and stay up to date with trends. This will help you understand the value of your collection and make informed investment decisions.

- Sales and profit taking::

- If you decide to sell part of your collection, do it in good time, monitoring the price and demand for individual bottles.

- Consider participating in mutual funds::

- If you don’t want to invest on your own, consider investing in funds that specialize in whiskey. This may be a less risky option for beginner investors.

- Buy with passion::

- Remember that investing in whiskey is not just a cold calculation. Enjoy the pleasure of searching, discovering new distilleries and building your collection.

There is no doubt that the answer to the question whether it is worth investing in whiskey is yes, and with a little effort and knowledge, you can create a collection of bottles whose value will increase.. This is a specific and non-obvious, but very interesting way of investing capital. However, remember not to waste your investment inadvertently. You can take a sip instead non-alcoholic whiskey.

Leave a Comment