Investing in Treasury Bonds

While unconventional investments such as art, unique alcohols or gadgets known from movies arouse interest and gain publicity in the press, investing in treasury bonds does not arouse emotions. This is because it is the least controversial and is described as a stable way of investing capital. The short-term profit is not mind-blowing, but the long-term perspective is usually promising.

Investing in Treasury Bonds – How Does It Work?

Treasury bonds are considered one of the safest forms of investment. investing money. At the beginning, it is worth emphasizing what every investor should know – namely the distinction between treasury bonds, corporate bonds and municipal bonds. Only the former are burdened with minimal risk.

Each type of bond, however, is a form of “loan.” The entity issuing the bonds to the market incurs debt from buyers.

The state is a debtor

Treasury bonds are nothing more than a way to lend money to the government and receive interest in return. It’s like lending money, but instead of a bank, the government is on the other side. In exchange for providing its savings, the government agrees to return the capital to you after a certain period of time, plus interest.

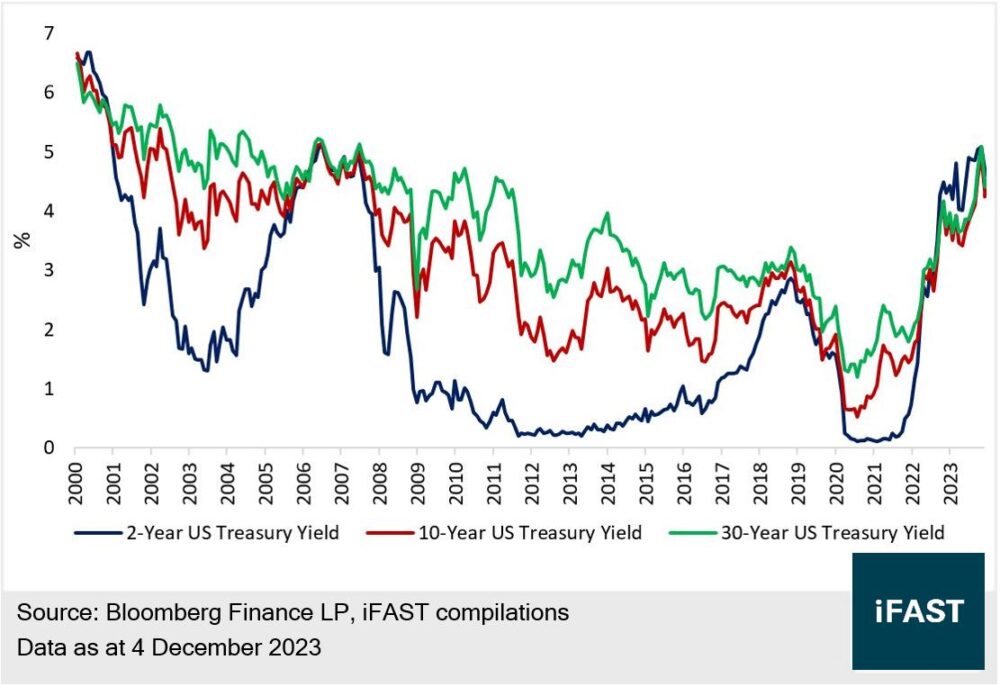

Interestingly, depending on the type of bond, you can choose between different investment options – from short-term (e.g. 3-month) with a fixed interest rate, to anti-inflation bonds, whose interest rate increases with inflation, which is a great hedge in unstable times.

Stability

Investing in Treasury bonds are also a good alternative to bank deposits. The main reason is their safety. In the case of bonds denominated in, the risk of the state’s insolvency is negligible. The state can always obtain funds from taxes or – in extreme cases – “print” money. Although this may sound a bit like a scenario from a movie about the economic crisis, such situations happen rarely, and on a global scale, they most often concern debt in foreign currencies. Although sporadically, states sometimes declare insolvency.

For many people, treasury bonds are the safest option. a form of capital investment, especially compared to bank deposits. When you make a deposit, you run the risk that the bank will fail. Such situations have happened many times. Banks fail regardless of latitude. The waves of crises that appear are often connected with the failure of banks.

Meanwhile, by investing in retail bonds, the government becomes your direct debtor, which in a sense makes it even safer than in a bank. What’s more, you can sell retail bonds before maturity, albeit for a small fee, which gives you extra flexibility. For those who are thinking about managing their savings safely in the long run, Treasury bonds seem like a really sensible option.

Investment portfolio structure

An investment portfolio is nothing more than a collection of various assets that we have to effectively manage our savings and multiply our capital. Imagine a portfolio as a basket into which we throw various “fruits” of investment – stocks, bonds, real estate or raw materials – each of these categories has its own unique features and different levels of risk. The key to success is not only the selection of these “fruits,” but also how they are distributed in our basket.

The ideal structure depends on the investor’s individual needs, goals, time horizon, and risk tolerance. It is said that the younger the investor, the more they should invest in riskier but potentially more profitable assets, such as stocks. In turn, the closer we get to the time when we want to use our savings, the more emphasis should be placed on stable assets, such as government bonds, which provide greater security.

How to divide a wallet?

The classic portfolio division is the so-called 60/40 rule, where 60% are stocks and 40% bonds. This approach works for investors with medium risk tolerance who are looking for a compromise between profit and safety. However, it is worth remembering that today this model is evolving. More and more people are including alternative investments in their portfolios, e.g. gold, cryptocurrencies or ETFs. Art or luxury items. They provide exposure to a variety of markets, often previously unavailable to the average investor.

A well-diversified investment portfolio should also include investments with different time horizons. Some assets should be available in the short term, in case of an emergency need for cash, while the rest can work over a longer period of time to build capital for the future.

In the case of large capital, it is worth considering alternative investments. Alcohol, cars, works of art are non-standard forms of capital investment, condo hotels or other real estate that cause balance. When one loses, the other gains.

Why diversification is so important

Investing in bonds, investing in gold, wine, cryptocurrencies – why is diversification so important?

Diversifying your investment portfolio is a strategy that helps minimize risk and build financial stability. Spreading your capital across different asset classes means that market fluctuations have a smaller impact on your overall investment. In a well-diversified portfolio, each part plays a different role – stocks can generate high profits during bull markets, commodities can protect against inflation, and treasury bonds can provide a solid base. Their biggest advantage is that they remain stable in more difficult market times, offering a steady, predictable income.

Investment in treasury bonds not only reduces the risk of losses, but also increases the security of the entire portfolio. That is why they are an important element of a long-term strategy, providing balance and certainty. The invested capital will not be exposed to drastic fluctuations.

Investing in Treasury Bonds – Advantages and Disadvantages

Although it would seem that treasury bonds have only advantages, it is not so obvious. Like any form of capital investment, it can be problematic and complicated. What are the advantages and disadvantages of this type of investment?

Treasury bonds – disadvantages

Defects investing in treasury bonds:

- Low interest rates – especially when compared to other forms of investment such as stocks, treasury bonds may offer relatively lower returns.

- Inflation risk – with high inflation, the real value of bond yields may be offset by a decline in the purchasing power of money.

- Long investment period – many treasury bonds require capital to be tied up for a longer period of time, which may limit the liquidity of the investment.

- Delays in response to market changes – interest rates on inflation-linked bonds may react with a delay, which may not fully protect against the ongoing effects of inflation.

- Lack of immediate flexibility – Treasury bonds are not listed on the market, which limits the possibility of selling them before maturity without losing part of the profit (in the event of early redemption).

Treasury bonds – advantages

Advantages of investing in treasury bonds:

- Stability – Treasury bonds are considered one of the safest investment instruments because they are issued by the government, which reduces the risk of default.

- Consistent income – investors can count on regular interest payments, providing a predictable income stream.

- Inflation protection – Inflation-linked bonds ensure that interest rates adjust in line with price increases, protecting the real value of earnings.

- No management fees – investing in retail treasury bonds does not involve additional costs, such as fund management fees.

- Possibility of diversity – the availability of different types of bonds, with different maturity dates and interest rates, allows you to tailor your investment to your individual needs and goals.

Investing in Treasury Bonds – Is This a Form of Capital Investment for You?

Investing in Treasury bonds is an option that attracts a diverse group of investors. It is of interest to both those who are taking their first steps in the world of finance and the more experienced. For beginners, treasury bonds are a safe way to invest savings, providing the certainty that their capital will not be exposed to too much risk. Experienced investors appreciate them for their stability and predictable income, which can be an excellent complement to riskier investments such as stocks. In addition, people planning long-term savings, for example for retirement, can take advantage of inflation-indexed bonds. They protect capital from depreciation due to inflation. Investing in Treasury bonds is also a good choice for those who value regular interest income and want to build a diversified portfolio. It is an option where security and stability go hand in hand with potential profit.

Leave a Comment