Is wine a good investment?

In ancient Greece, humanoid-shaped machines stood on the streets, dispensing a bit of exquisite—or not so exquisite—wine mixed with water to the thirsty in exchange for coins. The Greek inventor Philo of Byzantium, as early as around 220 BC, already knew that wine had potential. His robot is not only a brilliant example of Greek inventors’ genius but also one of the first investments in wine. In 2024, you don’t have to be an inventor to start your own vineyard, purchase an existing one, buy a bottle of a unique vintage, or invest in shares of a company specializing in wine. The question shouldn’t be whether wine is a good investment, but rather how to invest in wine to achieve success.

Is wine a good investment? Market analysis and outlook

Investing in wine has long been seen as an alternative form of investment that can yield significant returns. The choice of investment is not subject to fashion or fleeting trends. In 2024, the wine investment market continues to grow, with its dynamics indicating increasing interest from both individual investors and financial institutions. Much like the whisky market, it is an intriguing area for investors and for portfolio diversification.

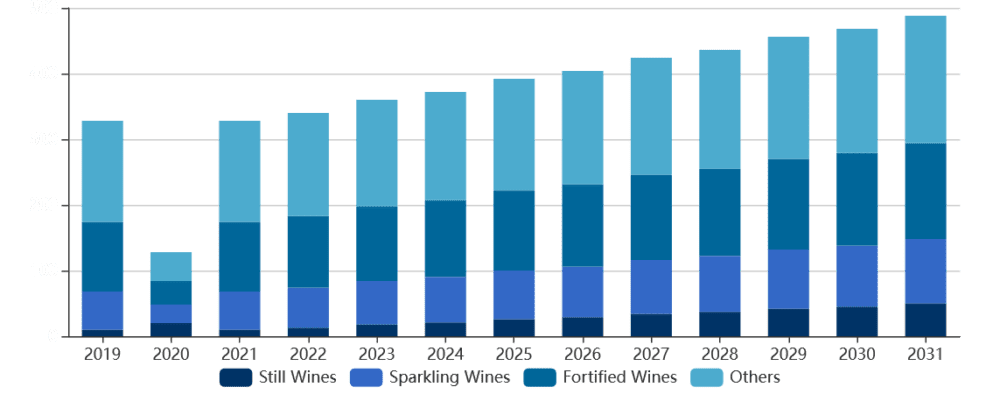

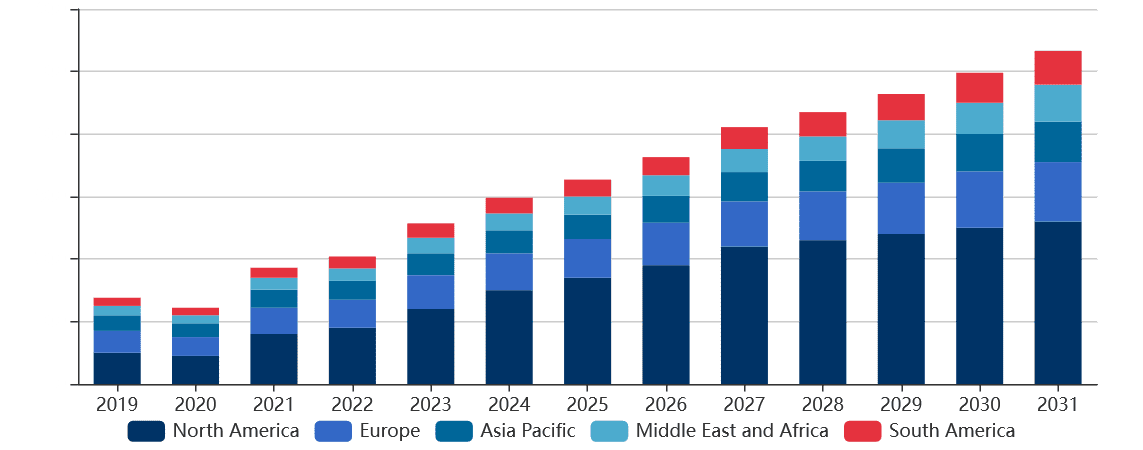

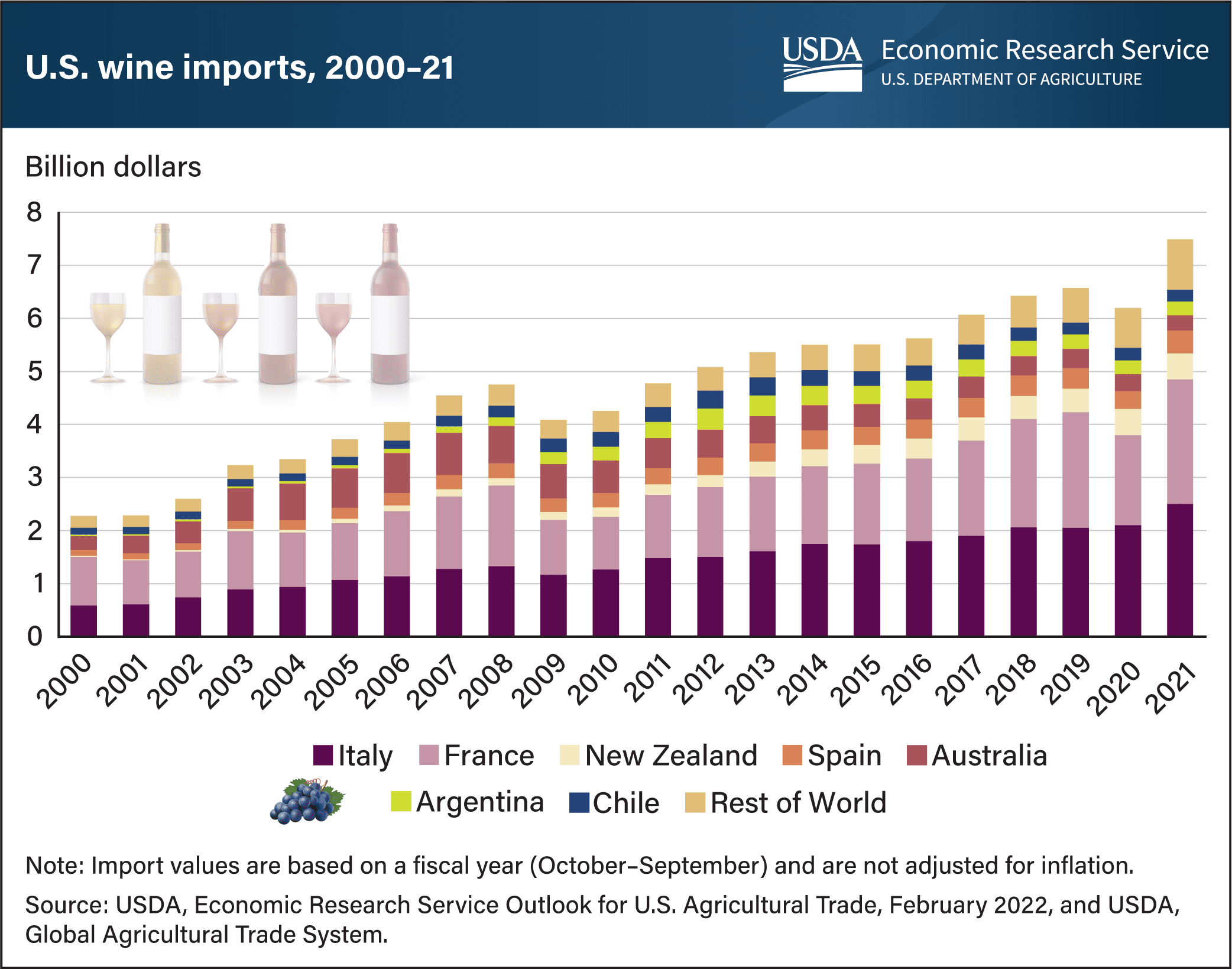

According to the latest “Global Wine Market Report 2024,” the wine market is projected to reach a value of $652.31 billion by 2030, growing at a CAGR of 6.37% from 2024 to 2030. The increasing demand for high-quality wines, especially in developing countries, as well as the rising interest in collectible wines, are contributing to this promising growth. Just like with whisky. So when considering whether wine is a good investment, it’s enough to look at the reports and charts.

Market driving factors

- Increased wine consumption: More and more consumers around the world are choosing wine as their preferred alcoholic beverage, which is driving demand for various types of wine, including premium wines.

- Growth of the collectible wine segment: Limited edition and aged wines are increasing in value over the years, making them an attractive investment asset.

- Portfolio diversification: Investing in wine is considered a way to diversify an investment portfolio, reducing the risks associated with more traditional investments.

Challenges and limitations

Despite the growing popularity of wine investment, there are also certain challenges and limitations that may affect this market:

- Market Regulations: Strict regulations on the sale and distribution of alcohol in various countries can hinder market growth.

- Changing Consumer Preferences: Consumer preferences can shift, which may affect the value of certain types of wine.

- Impact of Climate Change: Climate change can affect wine production, which may reduce the availability of certain vintages.

Future prospects

The outlook for investing in wine in 2024 appears promising. The wine investment market continues to grow, offering new opportunities for investors. Key segments such as red wines and sparkling wines are expected to see further growth. Additionally, advancements in technology, such as blockchain, may provide greater transparency and security for wine investments.

Recommendations for investors

- Market analysis: Investors should carefully analyze market trends and forecasts to make informed investment decisions.

- Investment diversification: It’s important to invest in different types of wine from various regions to reduce risk.

- Long-term approach: Investing in wine often requires a long-term perspective, as the value of wine can increase over time.

How to invest in wine?

The wine auction held on March 20 under the auspices of the British auction house Christie’s was remarkable not only for the value of the lots sold but also for highlighting the dynamic changes in the way wine is traded globally. Despite an almost empty auction room, with only a handful of observers following the bidding, the auction raised a dazzling £1.3 million. Of particular note was a lot of 12 bottles of Domaine de la Romanée-Conti from 1988, which sold for an impressive £232,750 ($305,135).

What was particularly interesting—and at the same time surprising—was that most of the bids came from remote bidders spread across five continents. Technology enabled real-time currency conversion, making it easier for collectors from around the world to participate. Tim Triptree, International Director of Wine at Christie’s, noted that as many as 41% of the auction house’s new clients are attracted by the online platform, reflecting the changing dynamics of the wine market.

This auction not only confirmed the dominance of online bidders, but also demonstrated that the younger generation—61% of buyers aged between 35 and 55—constitutes a significant part of the market. They are often the ones choosing to shop at auctions, seeking unique opportunities and collectible rarities. Such events not only reflect changing trends in wine trading but also highlight the growing global appeal of collectible wine bottles as an investment asset.

Instead of wondering whether wine is a good investment, it’s worth analyzing how to invest in it. The example above illustrates one option: purchasing a unique bottle and building a collection of wines from the finest vineyards and vintages. This approach to investing typically takes place at auctions and brings the buyer considerable prestige. The same is true for famous whisky auctions, where legendary rarities like The Macallan fetch astronomical prices.

Not just unique pieces

However, investing in wine isn’t just about bidding for rare bottles at auctions. In reality, that’s an option for only a select few. The industry actually offers many more ways to put your money into wine. The first and simplest is buying shares. Gallo, Concha y Toro, and Yellow Tail are powerful companies. The first owns vast vineyards and produces over 40% of the famous Californian wine. Interestingly, these giants don’t specialize in exclusive wines. Most of their products are sold in shops and supermarkets, becoming an everyday dinner companion for millions of people around the world. Good quality and affordable.

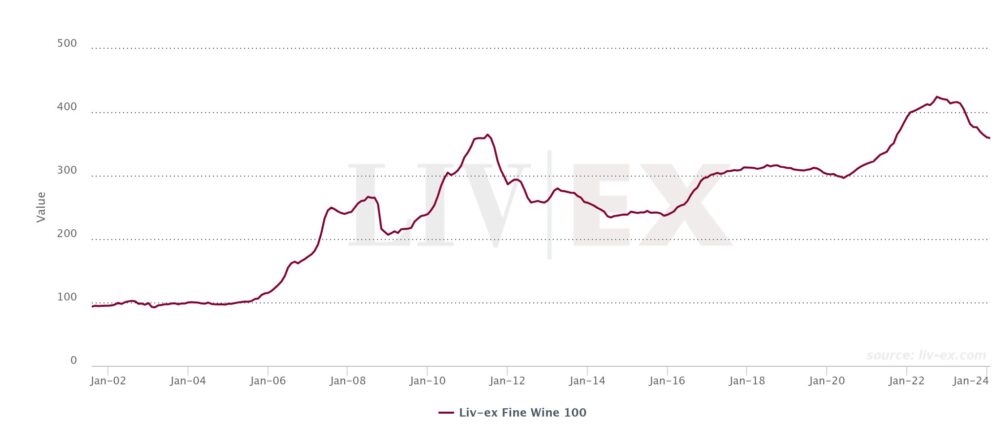

Nevertheless, according to Liv-ex, wine indices have recently experienced slight declines and corrections. However, the overall trend remains clearly upward. At the beginning of 2024, the fine wine market showed mixed results, presenting both challenges and opportunities for investors. The Liv-ex Fine Wine 100 index fell by 0.3% in January, indicating milder declines compared to previous months. Meanwhile, the broader Liv-ex Fine Wine 1000 index recorded a larger drop of 2.2%, with the biggest losses seen in wines from the Rhône region.

Digitization and online auctions are attracting younger buyers aged 35-55, shifting the market’s demographics. Regular updates to Liv-ex indices, which involve replacing less popular wines with those traded more actively, ensure their relevance and accuracy. The fine wine market remains dynamic, presenting both risks and opportunities for investors. The market for non-alcoholic spirits is also intriguing.

Or maybe your own vineyard

For true enthusiasts, buying your own vineyard is an option. Greek, Chilean, or Italian vineyards are stunning places, set in idyllic, picturesque landscapes. If wine is your true passion, it’s worth considering purchasing or starting your own vineyard. It’s a labor-intensive investment that requires time and commitment.

But producing and selling wine can be incredibly rewarding—not to mention profitable.

Wine trading business

Due to the growing interest in wine, it’s worth considering not only wine production or buying shares, but also investments related to distribution and sales. Luxury wine shops and small local stores cater to the demand of many people for purchasing wine, tasting, and access to bottles of various prices, flavors, and countries of origin.

With such possibilities, it’s hard to doubt that wine is a good investment. It’s almost a no-brainer.

The most expensive wines in the world

As a curiosity rather than an investment option, it’s worth discovering the most famous and expensive wines in the world.

After all, they attract the attention not only of connoisseurs, but also investors and collectors. Auction rarities that spark the imagination. Here are three of the most famous and expensive wines that have gained renown thanks to their prices and unique stories:

Screaming Eagle 1992 – This Californian wine, originating from Oakville in Napa Valley, was produced in 1986. It achieved a record price at a charity auction, where Chase Bailey paid $80,000 for it. Its prestige and rarity make it one of the most sought-after wines in the world.

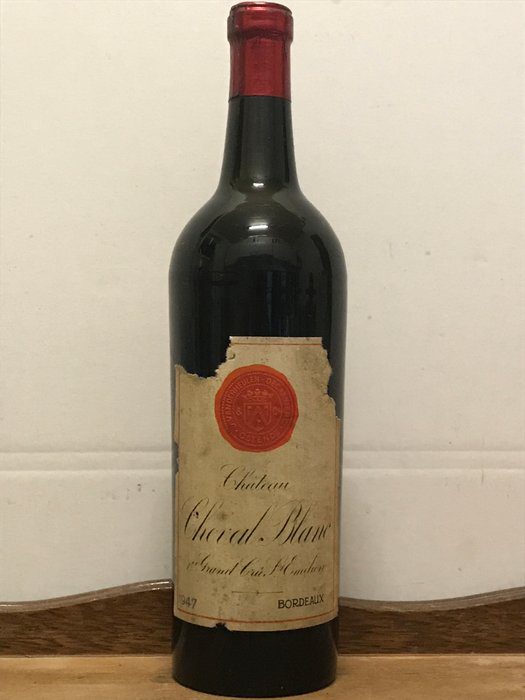

Cheval Blanc 1947 – This exclusive dry wine from the Bordeaux region is considered one of the greatest wines of all time.

One bottle of this extraordinary spirit reaches a price of $135,000. The 1947 Cheval Blanc is valued not only for its exceptional taste but also for its historic vintage.

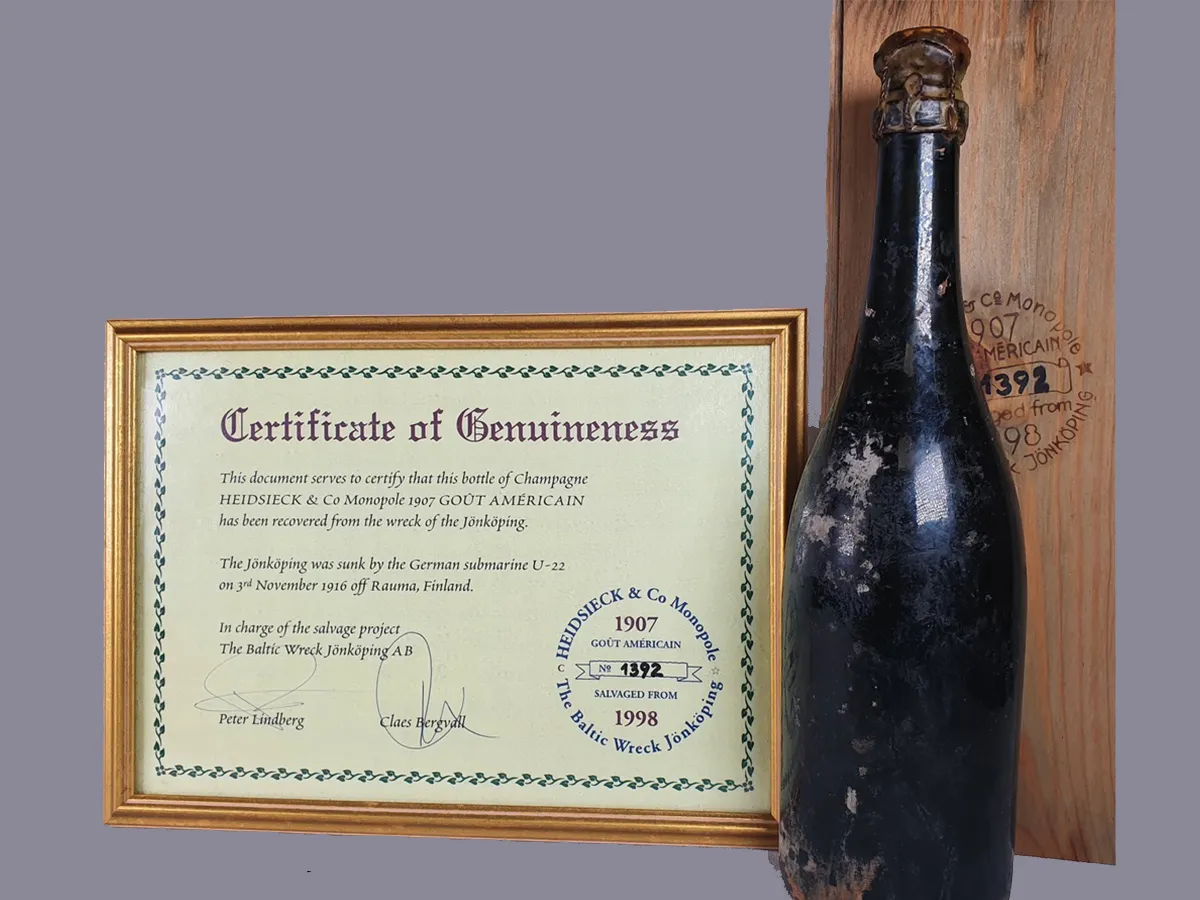

Heidsieck Champagne 1907 – This exceptional sparkling wine was produced in the early 20th century at the request of the Russian imperial family. A bottle of this champagne was discovered in a shipwreck in 1997, which made it even more valuable.

The history and age of this spirit make its price reach $275,000, making it one of the most expensive wines in the world.

These exceptional wines, with their unique stories and outstanding quality, command remarkable prices that highlight their prestige and significance in the world of wine.

Is wine a good investment? There are so many ways to invest in wine that it’s an option worth considering for both small and large investors alike. Whether you’re putting your money into stock market indexes or purchasing unique bottles, it’s definitely worth exploring this avenue. And a temporary dip in the indexes might be the perfect moment to enter the market.

Leave a Comment