Investing in art for the long term

Recently, on June 28, an exhibition of art from the collection of Wojciech Fibak opened in Torun. The famous tennis player is perhaps one of the most recognizable investors collecting ancient and contemporary art. His business portfolio is impressive, but the most important place in it is occupied by paintings. An exhibition of works from his vast collection of collectibles is a good point to consider what it looks like investment in art in the long term? What resources do you need to have and what do you need to take care of in order to get the paintings or sculptures right? Where can you buy valuable rarities and how to take care of them so that time does not erode their quality?

Investing in art for the long term

In many museums you can find a painting with the annotation: “on loan from a private collection.” Often these are world-class paintings of great fame. Private collections are not only beautiful and unusual, They are also a good way to build an investment portfolio and diversify capital deposits. Just like investing in wine or whiskey, just as art is one of the excellent ways to invest capital. However, you need to know what to invest in, how to select paintings or sculptures for your collection so that it not only pleases the eye, but also your bank balance. Stocks and bonds are only the most popular ways to invest.

Investment in art over the long term is one of the safest ways to invest capital, according to experts. It’s worth having a few valuable paintings in your portfolio, or acquiring works by young promising artists and watching them gain value. In the case of enthusiasts, it happens that they have an entire collection, far exceeding the mark of the investments. However, it is always ultimately a passion of increasing value.

The art of investing in art for the long term

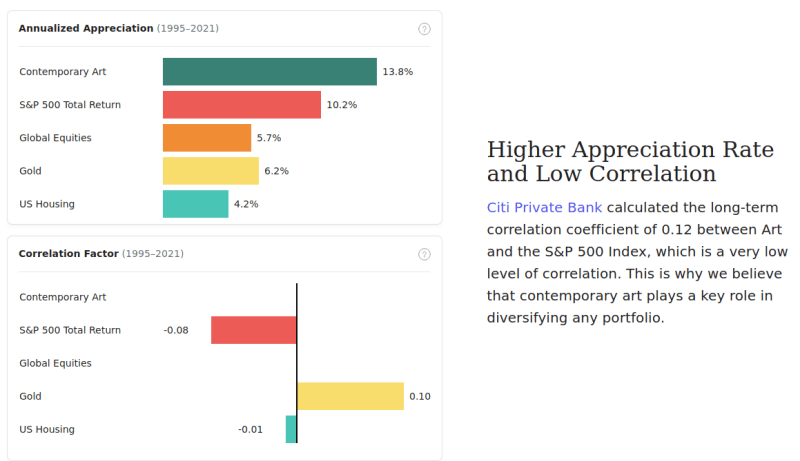

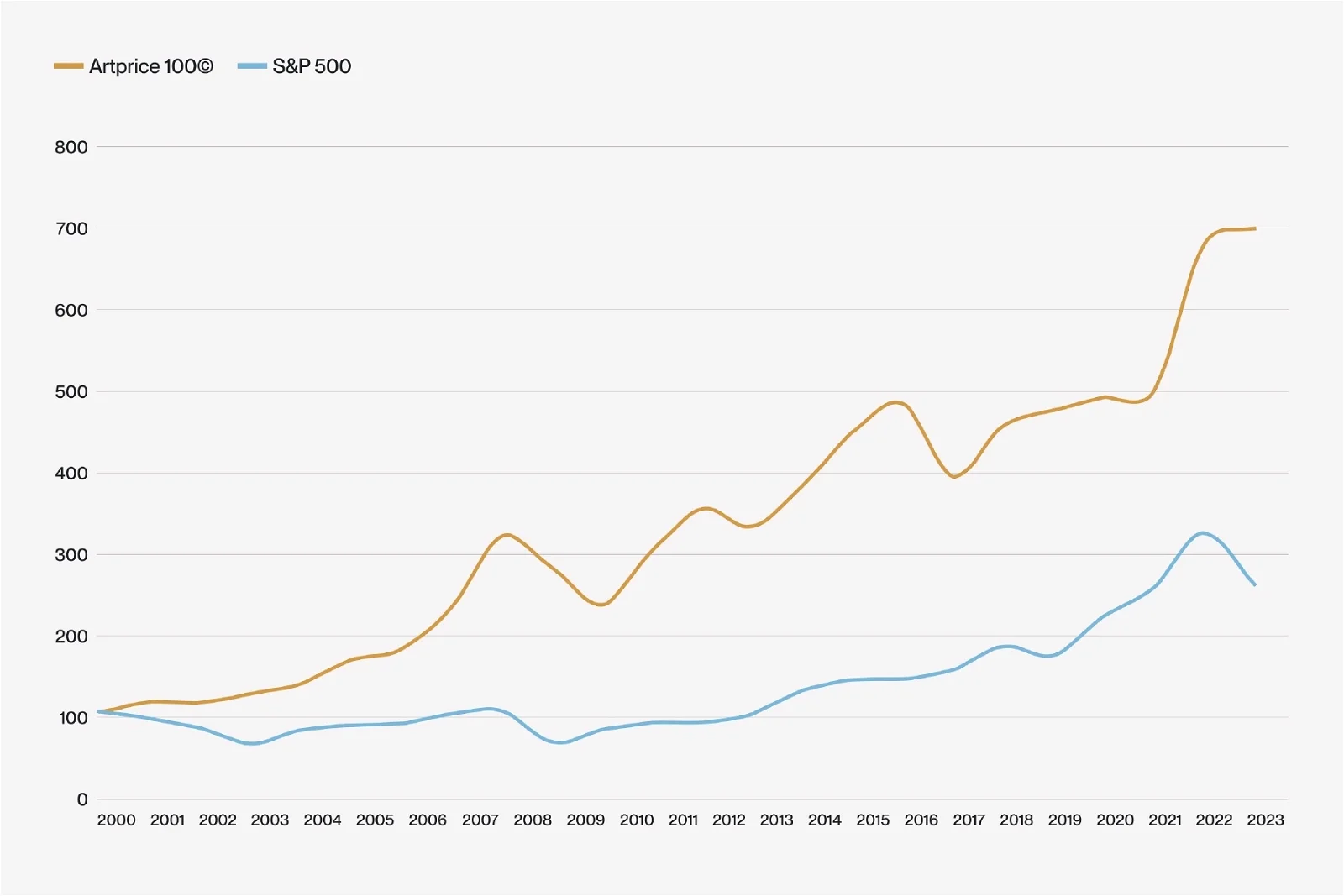

Investing into art can be a rewarding way to diversify a portfolio. It provides not only potential returns, but also aesthetic pleasure. As an alternative form of capital investment, art is less susceptible to the volatility of financial markets and offers stable, long-term returns. To successfully invest in art, it is important to have knowledge of the market, artists and trends, and to take expert advice.

Guide: How to invest in art

- Set your investment goals

- Determine whether your goal is primarily financial gain or enjoyment of artwork.

- Choose the type of art that interests you, such as contemporary art, classical art, graphic art, sculpture.

- Explore the art market

- Track trends, prices and results of auctions and exhibitions.

- Analyze data on artists and their previous market transactions.

- Consult an expert

- Find a trusted art advisor who has experience in your area of interest.

- Take advice from gallerists, curators and collectors to better understand the market.

- Determine the budget

- Determine how much you are willing to invest in artwork.

- Consider additional costs, such as storage, insurance and maintenance of artwork.

- Buy wisely

- Invest in the work of blue-chip artists, who are more stable, or emerging artists who can bring higher returns.

- Consider buying limited editions and graphics that can increase in value over time.

- Take care of your investments

- Store artworks in proper conditions to prevent damage.

- Regularly monitor the value of your collection and stay abreast of the market.

- Diversify your portfolio

- Invest in a variety of art forms and styles to minimize risk.

- Don’t limit yourself to one artist or type of art.

- Be patient

- Investment in art in the long term is very profitable.

- Give yourself time to gain knowledge and experience in the art market.

Where to buy artwork?

Works of art are a very interesting way to diversify an investment portfolio. There are many ways to acquire interesting and valuable works. The most reliable place, but also requiring a lot of capital, are auction houses. Auctions, such as those organized by Christie’s, Sotheby’s or Bonhams, offer a wide selection of artworks, often with guarantees of authenticity and detailed historical descriptions.

On your own, you can also search for works in galleries. However, this requires commitment, time and knowledge of the art world. Art galleries are an excellent place to acquire works by both established and emerging artists. Gallery owners often have close relationships with artists and can offer unique works and knowledge of their work. A final option is to buy directly from artists. It can be beneficial, especially if emerging talent is also to be included in the collection. Contact with the artist allows for a better understanding of the context and inspiration behind the work.

Sites such as Artnet and Artsy allow you to purchase artwork online, offering a wide selection of works from a variety of artists. Online auction platforms and online galleries can be a convenient way to purchase art without having to attend auctions or visit galleries in person.

In 2024, platforms such as Masterworks allow even those who are not passionate about art to invest in it. Masterworks allows people to purchase fractional shares of artworks by well-known artists, which increases the liquidity of these investments. Investors can easily transfer their funds back to traditional markets when the situation in those markets stabilizes.

Does it still make sense to invest in art in 2024?

Art, like other alternative assets, has a low correlation with major economic events and stimulants, such as Federal Reserve policy announcements. This means that, unlike stocks, cryptocurrencies or bonds, the value of artwork is not directly dependent on changes in interest rates or inflation. As a result, investments in art can ensure portfolio stability even during periods of heightened volatility in financial markets.

Market instability, armed conflicts or other political turmoil cause unexpected declines in stock markets. Bond declines. At a time when traditional financial markets are subject to unpredictable changes, alternative assets such as alcohols or art, are becoming an attractive investment option. They provide not only potential financial returns, but also the satisfaction of owning valuable and aesthetically appealing works of art. Investing in art in the long term is simply good business.

The most important auctions of the last two years

The year 2023 and the beginning of 2024 were exceptionally rich in events on the art market, bringing record sales and attracting the attention of collectors from all over the world. Below is an overview of the most important auctions that dominated these years. Investment in the arts over the long term is increasingly popular. And auctions can sometimes be exciting.

Evening Sale” auction at Sotheby’s

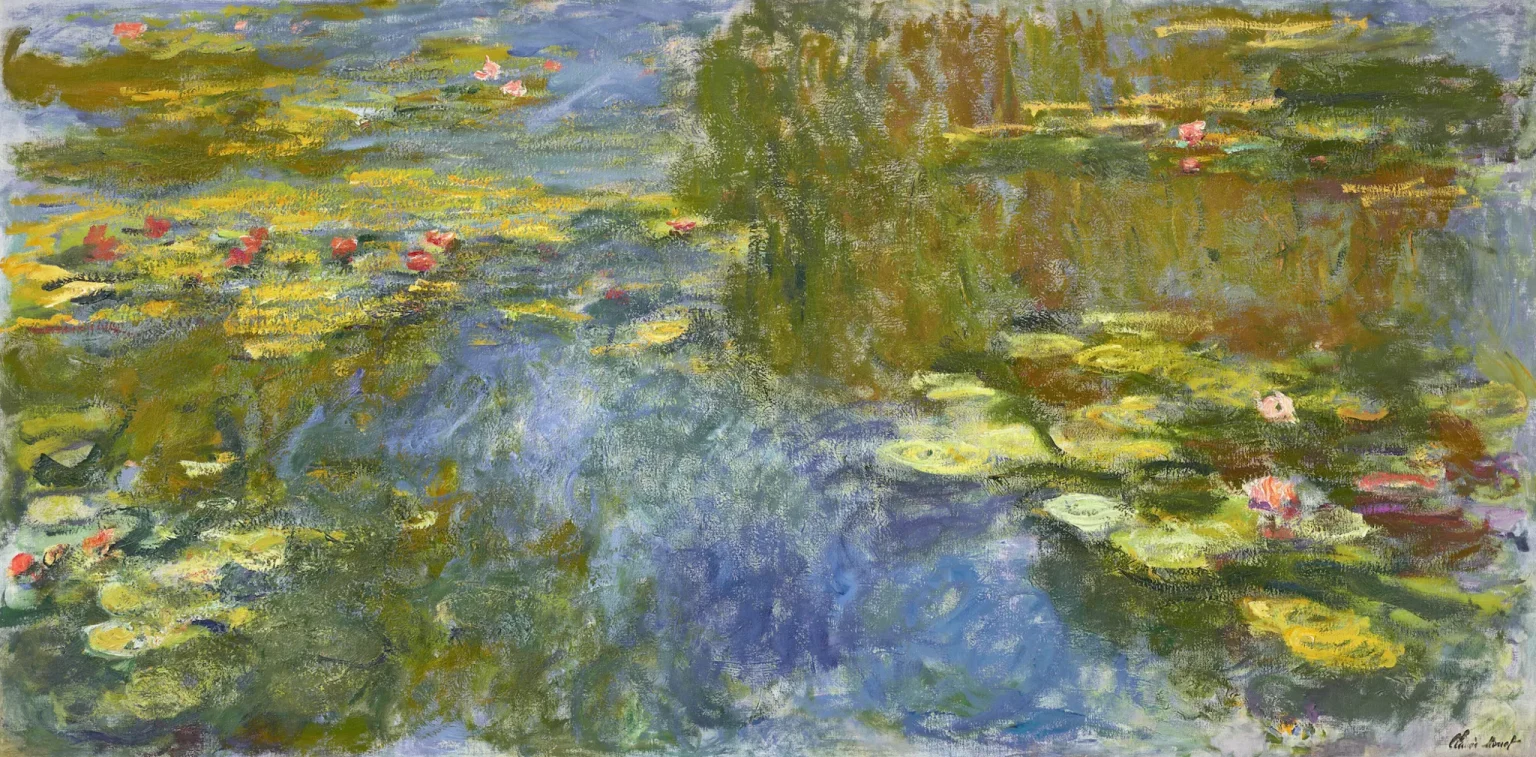

One of the highlights of the art market in 2023 was the “Evening Sale” auction at Sotheby’s in New York. Among the works auctioned were works by such masters as Pablo Picasso, Claude Monet and Mark Rothko.

photo: stationof.art

The record price was achieved by Monet’s painting “Nénuphars,” sold for $110 million.

Christie’s “Post-War and Contemporary Art”.

Christie’s held a “Post-War and Contemporary Art” auction in London in November 2023, auctioning works by contemporary artists.

The biggest sensation was the sale of Banksy’s work entitled “Love is in the Air,” which fetched a price of £12 million, setting a new record for the artist.

Phillips “20th Century & Contemporary Art”

Phillips also contributed to significant art market events in 2023 with the “20th Century & Contemporary Art” auction in New York. Among the works sold were works by Jean-Michel Basquiat and Gerhard Richter.

photo: stationof.art

Basquiat’s 1982 painting Untitled was sold for an impressive $85 million. The same author’s painting El Gran Espectaculo (Nile), 1983, shown above, sold for $5.2 million in 2005 and $67.1 million in 2023. A triptych with the theme of the history of slavery has appreciated tremendously in the long term.

Jean-Michel Basquiat, El Gran Espectaculo (Nile), 1983. courtesy of Christie’s Images Ltd. 2023.

Art Basel in Miami Beach

The Art Basel fair, held in December 2023 in Miami Beach, also attracted the attention of collectors and investors. It was one of the most important art fairs of the period, showcasing works by both promising young artists and established artists. Among the most interesting transactions was the sale of Yayoi Kusama’s installation for $15 million.

Auction to benefit the Leonardo DiCaprio Foundation

A unique auction organized by the Leonardo DiCaprio Foundation took place in January 2024 to raise money for environmental charities. Among the works on display were works by artists such as Damien Hirst, Takashi Murakami and Tracey Emin. The auction brought in a total of more than $30 million, a huge success.

Sotheby’s “Modern & Contemporary African Art”.

In March 2024, the “Modern & Contemporary African Art” auction at Sotheby’s in London highlighted the growing importance of African art on the global market. The biggest event was the sale of a painting by Nigerian artist Ben Enwonwu for £3 million, setting a new record for African art.

Auction “The Collection of Peggy and David Rockefeller”.

The auction of “The Collection of Peggy and David Rockefeller,” held by Christie’s in May 2024, was one of the most anticipated events of the year. The collection, which includes works by artists such as Henri Matisse, Diego Rivera and Edward Hopper, reached a total of $832 million, making it one of the most valuable private collections in the history of the auction.

photo: stationof.art

The year 2023 and the beginning of 2024 have proven that the art market remains dynamic and full of surprises, bringing record prices and exceptional works to global auctions. The next few months promise to be equally exciting for the collectors and art lovers around the world.

Leave a Comment