Sotheby’s – from a London antiquarian bookshop to a global art market giant

Did you know that art auctions can attract more money than the combined annual budget of all Polish museums?

Sotheby’s is a company that has been around since March 11, 1744. To put that into perspective—when this company was founded, Poland had not yet been partitioned by foreign powers. And today? Its annual turnover exceeds 7 billion dollars. That’s roughly the same as the budget of the National Museum in Warsaw… for the next 350 years.

The global reach is impressive—80 offices in 40 countries. But what does that mean for you? It means that sitting at home in Poland, you can bid on a van Gogh or a Picasso online. No need to leave your house, no need to travel to London or New York. All you need is a good internet connection and the right amount in your account.

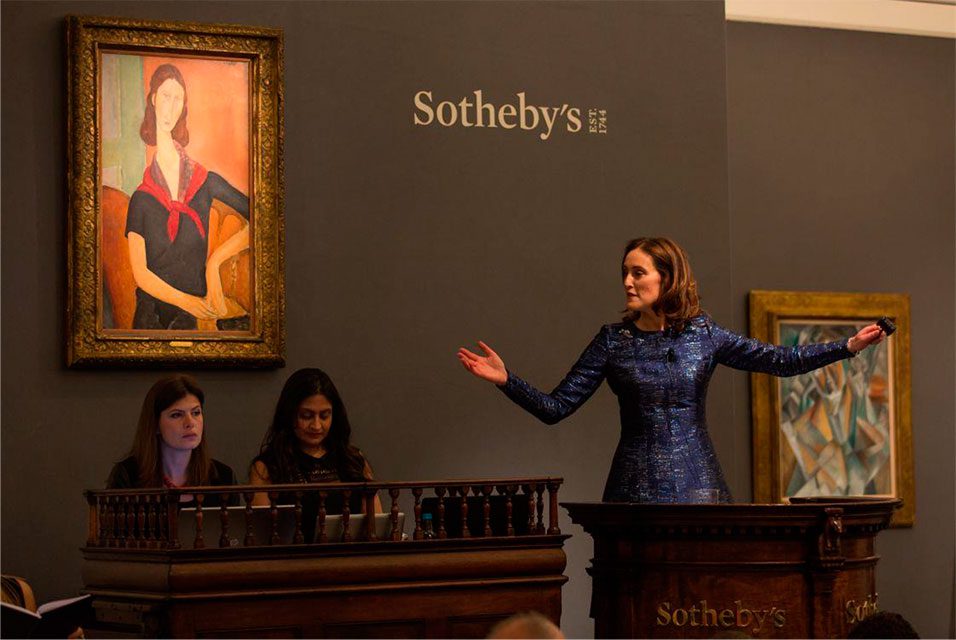

photo: rynekisztuka.pl

Sotheby’s – from ancient books to digital tokens

In 2025, Sotheby’s is once again making headlines. Not just for record-breaking Old Masters sales. The company has made a bold entry into the world of NFTs and is using artificial intelligence to appraise artworks. This is no longer just the old world of collectors in tuxedos.

Why should you care, even if you’re not planning to buy million-dollar paintings? Because Sotheby’s is a barometer for the entire art market. It shows where collecting is headed and what trends will shape the value of artworks. And who knows—maybe one day you’ll find something valuable in your grandmother’s attic?

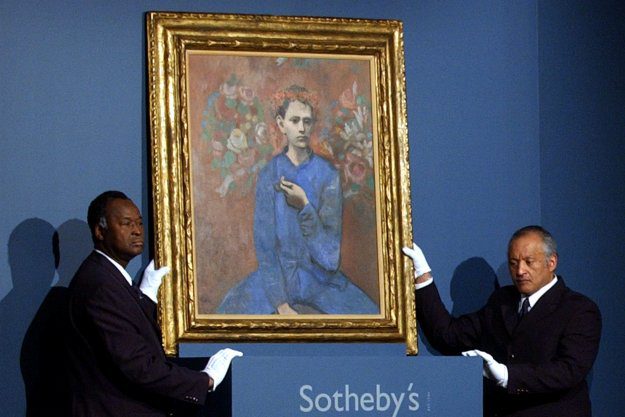

photo: bloomberg.com

In this article, you’ll find three key threads:

• History – from a London bookshop to a global empire

• Business model – how they profit from your dreams of owning a Monet

• The future – digital tokens, AI, and what’s next for collectors

Let’s start at the beginning. With the little bookshop that changed the world of art.

280 years of change – the most important milestones in Sotheby’s history

Imagine holding a book worth a fortune in your hands. That’s exactly what happened on March 11, 1744, when Samuel Baker conducted the first auction of what would later become the Sotheby’s empire. He sold Sir John Stanley’s library for £826—a sum that may seem trivial today, but was serious business at the time.

| Year | Event |

|---|---|

| 03/11/1744 | The first auction of Sir John Stanley’s library for £826 |

| 1917 | Moving to New Bond Street in London |

| 1955 | Opening of the New York branch |

| 1977 | Debut on the London Stock Exchange |

| 1983 | Acquisition by A. Alfred Taubman |

| 2000 | Commission-fixing scandal – $512 million settlement |

| 2019 | Privatization by Patrick Drahi for $3.7 billion |

These books turned out to be much more than just paper with text. They became the foundation of the entire art market as we know it today. Samuel Baker probably had no idea he was founding a dynasty that would last nearly three centuries.

The move to New Bond Street in 1917 was a stroke of genius. Even then, this London street exuded class—elegant boutiques, wealthy clients strolling the sidewalks. Sotheby’s not only found itself at the heart of the luxury trade, but actually helped create that very center.

After World War II, there was a real boom. People craved beautiful things after years of destruction and scarcity. Sotheby’s opened a branch in New York in 1955, and later went public in 1977. But the real revolution came with Alfred Taubman, who bought the company in 1983. This American developer turned auctions into a show—more marketing, more spectacle, more money.

But every story has its dark side. In 2000, a commission-fixing scandal with Christie’s erupted. Both companies secretly agreed on the prices of their services, a textbook example of illegal monopoly. Sotheby’s paid $512 million in settlements, and Taubman went to prison. It was a shock to the entire industry.

The last major turning point was privatization in 2019. Patrick Drahi, a French billionaire, bought Sotheby’s for $3.7 billion and took it off the stock market. Some said it was the end of an era, others—the beginning of a new one.

The history of Sotheby’s is really the story of capitalism in a nutshell. It started with a modest book auction and ended as a global empire valued in the billions. Every crisis, every change of ownership, every scandal only strengthened the company’s position in the market.

All these transformations show just how much the art world has changed over the past 280 years. Today, Sotheby’s faces a whole new set of challenges.

photo: artnews.com

The modern face of the auction house – sales models, innovations, and challenges

May 2021. Sotheby’s puts the first-ever NFT up for auction—the famous “Bored Ape #3491” sells for an astronomical $3.4 million. I remember thinking at the time—is this madness, or the future? It turns out, that was just the beginning of a complete market transformation.

Today, Sotheby’s is much more than the auctions we associate with the movies. It’s four different businesses in one. Traditional auctions remain the core—those legendary live bids in New York and London. Private sales cater to clients who prefer discretion—quiet transactions without public bidding. Financial services? The auction house lends money against works of art. And Sotheby’s International Realty is a whole different world—selling luxury homes from Manhattan to Monaco.

photo: business-standard.com

The scale is impressive. Over $7 billion in turnover in 2023. 80 offices in 40 countries. This is no longer an elegant niche company—it’s a global powerhouse.

| Sales format | Duration | Audience | Example |

|---|---|---|---|

| Live auction | 2-4 hours | On-site + online | Evening Sale Impressionist |

| Online auction | 7-14 days | Online only | Modern Art Day Sale |

| Private sale | Weeks/months | Invited clients | Blue-chip masterpieces |

| NFT auction | 24-48 hours | Crypto community | Digital Art Collection |

Artificial intelligence is also making its way into valuations. In 2025, Sotheby’s is testing algorithms that analyze thousands of transactions and can predict a painting’s price with 85% accuracy. Sounds fantastic, but does an algorithm understand a collector’s emotions? I doubt it.

The metaverse is another experiment. Virtual galleries where you can view artworks before the auction without leaving your home. Some say it’s the future, others call it a gadget for the wealthy bored with reality.

But not everything is perfect. Provenance remains the number one issue. How many paintings have questionable origins dating back to wartime? Transport is another headache—how do you move priceless works when everyone is talking about carbon footprints? And price speculation? Some pieces are bought only to be sold at a higher price a year later.

The most interesting thing is that despite all this technology, people still want to touch, to feel the texture of the canvas. Maybe that’s why live auctions will never disappear. Digitization, yes, but without the magic of the Sotheby’s auction room, it just wouldn’t be the same.

photo: rynekisztuka.pl

What’s next for the London legend – conclusions for collectors and the future market

Sotheby’s is more than just an auction house—it’s an entire ecosystem that will continue to evolve for decades to come. The key takeaway? There’s no point in waiting for the “perfect moment” to take action.

Why should you consider Sotheby’s now? First, its global reach means your piece could end up with a collector in Hong Kong or New York. Second, expert authentication guarantees authenticity you won’t find on a typical auction platform. Third, there are multiple sales formats, from classic auctions to private sales.

The outlook for the coming years is impressive—turnover could exceed $10 billion by 2030. Asia will drive this growth. Chinese and Japanese collectors are already setting prices in certain categories.

What can we expect by 2030? Auctions in the metaverse will become the norm, not a novelty. Fractional ownership will let you buy shares in expensive works—just like stocks on the exchange. Green logistics will transform how art is transported between continents.

That’s exactly what I’ve been thinking about lately—does a Polish collector stand a chance in this game? Yes, but you have to act wisely.

photo: rynekisztuka.pl

Your next steps should be concrete decisions, not dreams. Set up auction alerts for categories that interest you. Consider taking courses at Sotheby’s Institute—it’s an investment in knowledge that will pay off. Explore financing options secured by artworks—banks are increasingly offering such solutions.

Don’t forget the technical aspects. The Sotheby’s mobile app lets you bid from anywhere in the world. That changes everything—you no longer have to fly to London to take part in an auction.

photo: rynekisztuka.pl

One thing I wonder—will we even distinguish between ” online ” and “offline” auctions in ten years? Probably not. The hybrid model already dominates.

“Art is the only thing you can buy that makes you richer,” as Winston Churchill once said.

Tom

lifestyle editor

Luxury Blog

Leave a Comment