Is it worth investing in a condohotel?

Investing in real estate, buying apartments for rent and apartments for tourists is one of the safest and most secure ways to invest capital. At least that’s the general opinion. However, while the private area of buying and monetizing real estate is quite common, condohotels continue to raise questions. To begin with, considerations, whether it’s worth investing in a condohotel it is necessary to define what it is and to think about the potential of this type of business over the years.

Is it worth investing in a condohotel?

Every investor with a lot of capital to deploy, at some stage considers putting a certain amount of money into real estate. You don’t have to own like Thomas Shelby from Peaky Blinders more than 200 townhouses to make money on apartments, houses, condos or hotels. You don’t have to be a hotel owner to invest in rooms. After all, condohotels are a solution and an interesting option.

So is it worth investing in a condohotel? Condohotels are an interesting option for safe capital investment in real estate. Often located in popular tourist destinations and large cities, these buildings offer the possibility of generating rental income for tourists and people on business trips. Investors can count on some returns, with the facility operator taking care of the maintenance of the common areas. This relieves owners of the day-to-day management duties. However, compared to traditional rental apartments in larger cities, profits from condohotels are more seasonal. They also depend on the quality of the operator’s service and the location of the development.

What is a condohotel?

A condohotel is a specific type of property that combines the features of a traditional hotel and a residential building. They can be found mainly in attractive tourist locations, such as seaside resorts or mountain resorts, although they are also found in large cities and business centers. In a condohotel, individual rooms have the status of legal separateness – they have their own land registers, which allows them to be bought, sold and rented on a basis similar to developer apartments.

In a condohotel, the buyer becomes the owner of a specific room, which he can use for both his own leisure and short-term rentals. This model allows owners to reap the financial benefits of renting. Typically, contracts with the facility operator stipulate that the owner can use the property for a few weeks a year, while the rest of the time it is rented out to guests, generating income for the owner.

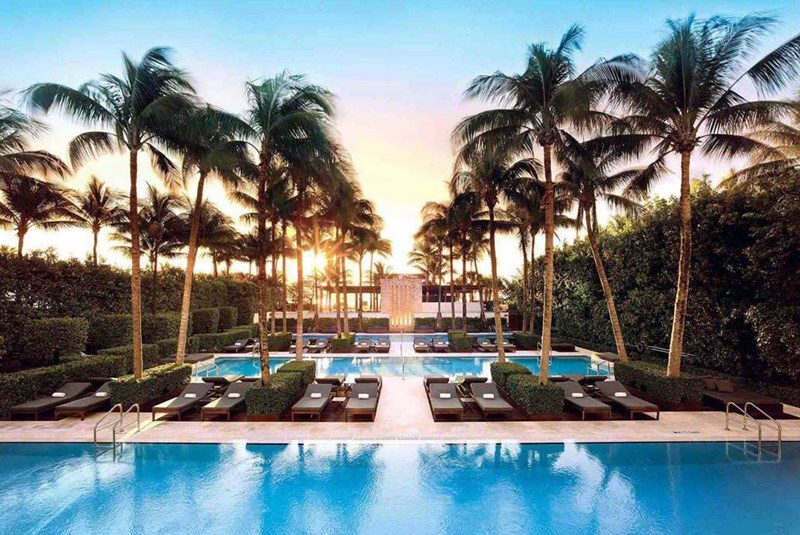

Condohotels represent the sector premium real estate. These developments are characterized by a high standard of finishes, luxurious furnishings and a wide range of hotel services, such as reception, room service, spas, restaurants and swimming pools. This is undoubtedly a premium market.

Condohotels and hybrid aparthotels are gaining popularity in most major cities and vacation resorts around the world. They represent a rapidly growing type of mixed-use real estate investment. In developed markets, condohotels account for between 10 and 20% of premium hotel properties, although there is wide variation. In Bangkok they account for only 4%, while in coastal Miami as much as 40% of properties are condohotels.

Why are condohotels popular?

Condohotels attract investors and operators hotels because of the benefits they offer to both parties. The hotel operator receives a finished and equipped hotel in a top location, while the investor gains the opportunity to safely invest capital with an attractive rate of return. Although the construction of a luxury resort can cost more than $500 million, demand for this type of property abroad remains steady. The vacation apartment market is booming, as seen in projects such as the Waikiki hotel in Hawaii, where all 500 apartments were sold on the first day for a total of $700 million.

Luxury condohotels – an investment in prestige

Thanks to the infrastructure hotel, tailored services and the brand and experience of the operator, a condohotel is an exclusive investment. This type of property ensures smooth generation of economic benefits for both the hotel manager and the owners of individual apartments.

Globally, condohotels are popular in luxury resorts and tourist areas. Examples can be found in places like Miami, where this type of property emerged as early as the 1950s, as well as in prestigious locations in Europe, Asia and the Middle East. In many countries, condohotels are valued by investors for their ability to diversify their portfolios and potentially higher returns compared to traditional real estate investments.

Real estate market 2024 – potential and threats

Investing in real estate remains an attractive option in 2024, despite the challenges of high interest rates, inflation and high housing supply. The real estate market offers a variety of investment opportunities that can yield long-term returns, both in the commercial and residential sectors. Condohotels, which are a unique combination of hotel and apartment, are also an interesting investment alternative.

How to invest in real estate in 2024?

- Purchase and lease of real estate:

- Investing in rental properties, both commercial and residential, can bring in regular passive income. Popular options include apartments, single-family homes and commercial units.

- Fix and Flip:

- Buying, renovating and selling a property (“fix and flip”) allows for quick profits, provided that renovation costs are skillfully managed and the location is chosen appropriately.

- Condohotels:

- Investing in luxury hotel rooms or condohotel apartments allows you to use the property personally, as well as generate income from short-term rentals. This model reduces the owner’s responsibilities by having the property managed by a professional operator.

- Investment and private equity funds:

- Investing through funds specializing in real estate or participating in private equity can be more diversified and less demanding in terms of management.

Advantages and disadvantages of investing in real estate in 2024

Advantages:

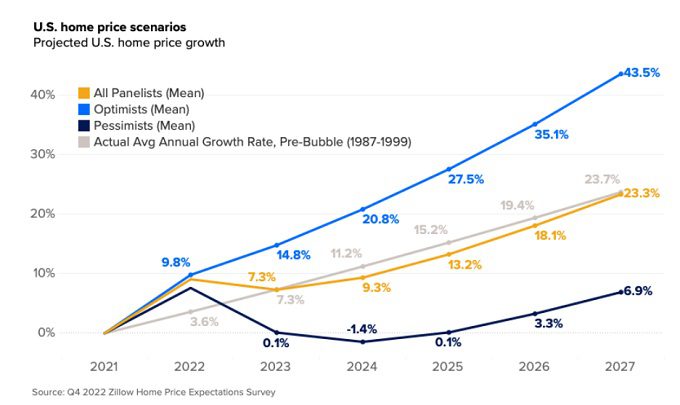

- Value growth potential: Long-term appreciation in property values can yield significant capital gains.

- Passive income: Rental property provides a regular income, which can be attractive especially in times of low interest rates.

- Diversification: Adding real estate to an investment portfolio allows diversification of risk.

Risks:

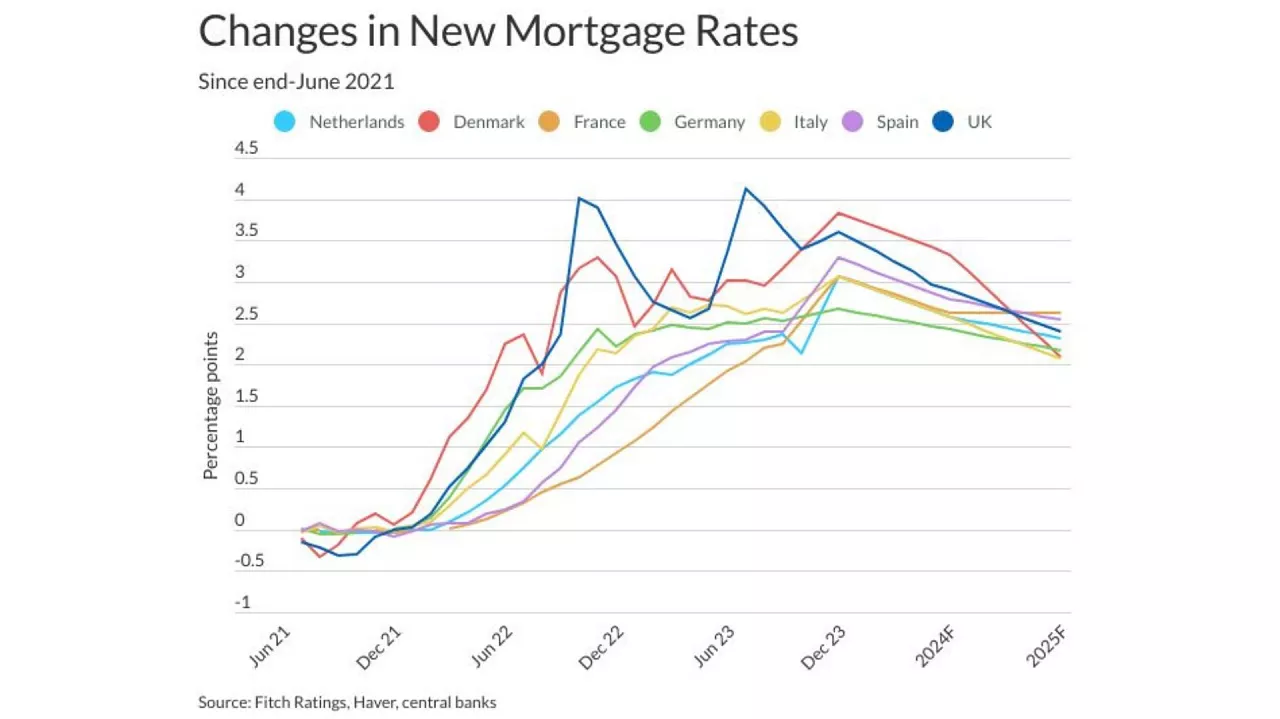

- High interest rates: They can increase financing costs and reduce the profitability of investments.

- Seasonality of income: Particularly in the case of condohotels, income can be seasonal and dependent on the quality of management of the property.

- Fluctuations in property values: Economic instability and changes in interest rates can affect property valuations.

Despite some challenges, real estate still offers solid investment opportunities in 2024. The key is to carefully study the market, assess the risks and adjust the investment strategy to current economic conditions.

Condohotels – property on special terms

Condohotels are an interesting form of investment, combining elements of hotel and apartments. Although the first such facility was built in the 1950s in Miami, condohotels did not begin to appear in Europe until the 1990s. Is it worth investing in a condohotel, or is it better to look at other real estate markets.

Principles of investing in a condohotel

The main difference between investing in a condohotel and buying a traditional apartment is the type of contract. In the case of condohotels, it is usually a preliminary agreement rather than a development agreement. This difference is important because a preliminary agreement is less protective of the buyer’s interests, often lacking the developer’s obligations to conduct a technical audit and repair defects before finalizing the transaction.

Facility management is a key part of the investment. The condohotel operator takes care of the maintenance of the common areas, the reception area, advertising of the property and other duties related to the daily operation of the hotel. The investor has limited influence over management, which can be both an advantage and a disadvantage. Profit sharing is also worth noting. The most common models are 50/50 or 70/30 in favor of the property owner, but you have to factor in costs related to taxes and property insurance.

Advantages and disadvantages of investing in a condohotel

One of the main advantages of investing in this type of real estate is the possibility of a high rate of return, which can be as high as 10% with a well-run investment. The investor does not have to manage the property personally, which is a considerable convenience compared to traditional rental apartments. In addition, the investment in the property protects the capital from inflation, and the owner has the opportunity to use the property during selected periods.

Unfortunately, condohotels also have their drawbacks. Profits are limited by the duration of the contract with the operator, and VAT on hotel services applies at the full rate. It is also not possible to purchase such a property on a mortgage, and the price per square meter is higher than in development condition. The investment is also dependent on the quality of the operator’s service. Thus, this is a business for investors with adequate funds and ready for a return spread over time. So is it worth investing in a condohotel – as one way to invest it will work perfectly. As the only one, not necessarily.

What to look for when buying a condohotel unit?

When buying a condohotel unit, it is crucial to carefully read the terms of the preliminary agreement and protect your interests. It is worth paying attention to the experience of the developer and the operator of the facility, as well as the conditions regarding management. Down payments and deposits can be high, so be prepared for such costs.

Is it worth investing in a condohotel? It is certainly a good option for portfolio diversification and a way to earn a stable income. Well, and we have a secure vacation spot.

Leave a Comment