Investing in art from a long-term perspective

Recently, on June 28, an art exhibition from the collection of Wojciech Fibak opened in Toruń. The renowned tennis player is arguably one of the most recognizable investors collecting both classical and contemporary art. His business portfolio is impressive, but paintings hold the most prominent place within it. The exhibition of works from his vast collection provides a great opportunity to reflect on from a long-term perspective. What kind of resources are needed, and what should you pay attention to in order to select the right paintings or sculptures? Where can you buy valuable one-of-a-kind pieces, and how do you care for them so that time doesn’t diminish their quality?

Investing in art from a long-term perspective

In many museums, you can find paintings labeled: “on loan from a private collection.” Often, these are world-class works of great renown. Private collections are not only beautiful and extraordinary, but they’re also an excellent way to build an investment portfolio and diversify your assets. Just like investing in

According to experts, investing in art over the long term is one of the safest ways to allocate capital. It’s worth having a few valuable paintings in your portfolio, or acquiring works by young, promising artists and watching their value grow. Enthusiasts sometimes end up with an entire collection that goes far beyond the definition of an investment. Yet, it always remains a passion that continues to appreciate in value.

The art of investing in art from a long-term perspective

Guide: How to Invest in Art

- Set your investment goals

- Determine whether your primary objective is financial gain or the enjoyment of owning works of art.

- Choose the type of art that interests you, such as contemporary art, classical art, prints, or sculpture.

- Explore the art market

- Track trends, prices, and the results of auctions and exhibitions.

- Analyze data on artists and their previous market transactions.

- Consult an expert

- Find a trusted art advisor with experience in your area of interest.

- Seek advice from gallerists, curators, and collectors to better understand the market.

- Set your budget

- Decide how much you are willing to invest in artworks.

- Consider additional expenses such as storage, insurance, and art maintenance.

- Shop smart

- Invest in blue-chip artists’ works, which tend to be more stable, or emerging artists who may offer higher returns.

- Consider purchasing limited editions and prints, which can appreciate in value over time.

- Protect your investments

- Store artworks in proper conditions to prevent damage.

- Regularly monitor the value of your collection and stay up to date with the market.

- Diversify your portfolio

- Invest in various forms and styles of art to minimize risk.

- Don’t limit yourself to a single artist or type of art.

- Be patient

- Investing in art is highly profitable in the long run.

- Give yourself time to gain knowledge and experience in the art market.

Where to buy works of art?

Works of art are a fascinating way to diversify your investment portfolio. There are many ways to acquire interesting and valuable pieces. The most reliable, though also requiring significant capital, are auction houses. Auctions organized by Christie’s, Sotheby’s, or Bonhams offer a wide selection of artworks, often with authenticity guarantees and detailed historical descriptions.

You can also search for artworks on your own in galleries. However, this requires commitment, time, and familiarity with the art world.

Websites like Artnet and Artsy allow you to purchase artworks online, offering a wide selection of pieces from various artists. Online auction platforms and virtual galleries can be a convenient way to buy art without having to attend auctions or visit galleries in person.

In 2024, platforms like Masterworks make it possible to invest in art even for those who aren’t enthusiasts. Masterworks allows you to purchase fractional shares in works by renowned artists, increasing the liquidity of these investments. Investors can easily move their funds back to traditional markets once conditions stabilize.

Does investing in art still make sense in 2024?

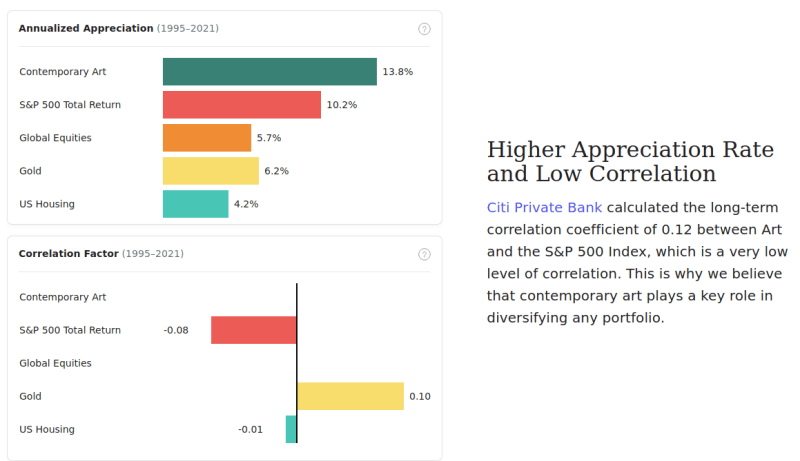

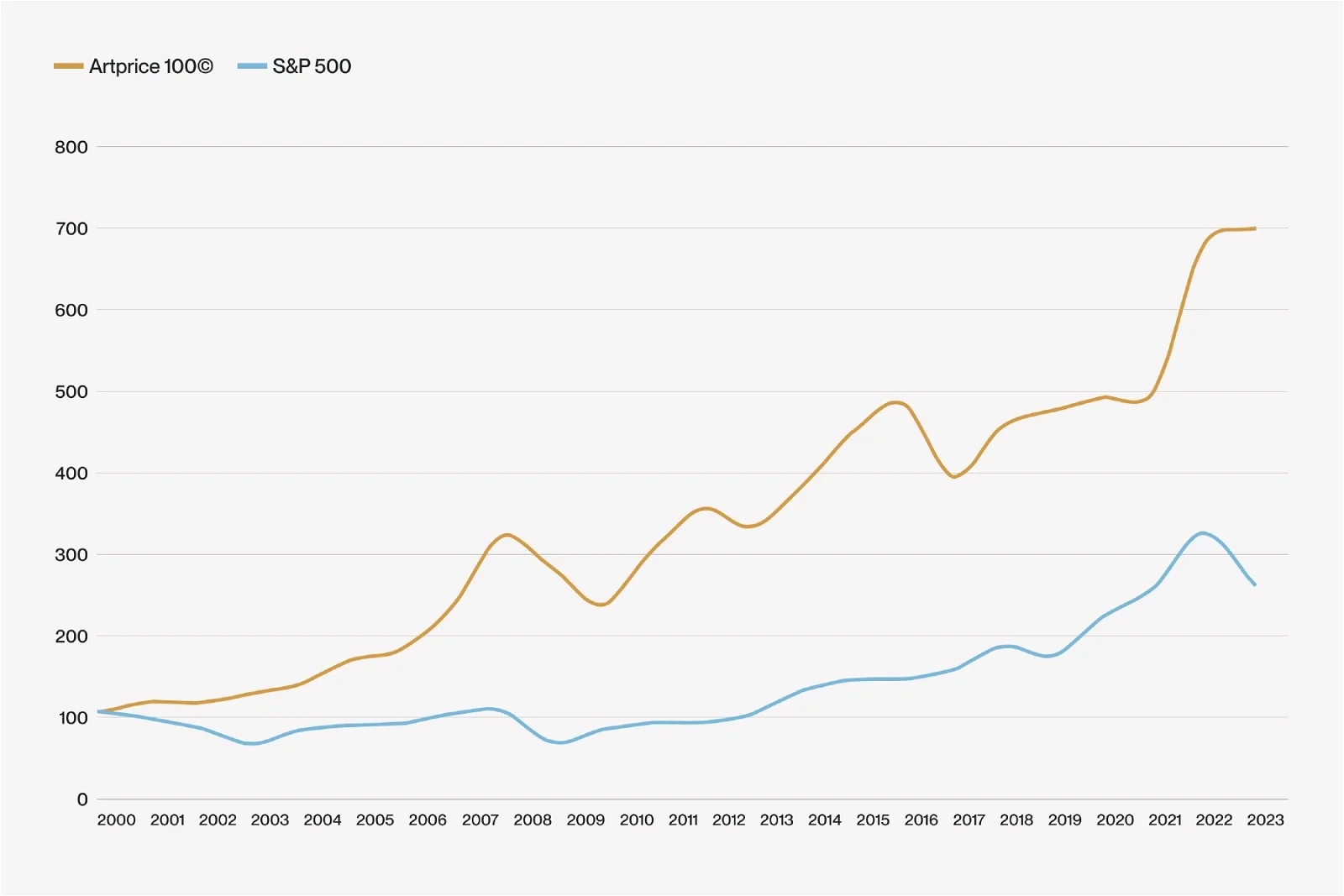

Art, like other alternative assets, shows low correlation with major economic events and stimulants such as Federal Reserve policy announcements. This means that unlike stocks, cryptocurrencies or bonds, the value of artworks is not directly dependent on changes in interest rates or inflation. As a result, investing in art can provide portfolio stability even during periods of heightened volatility in financial markets.

Market instability, armed conflicts, and other political upheavals can trigger unexpected downturns on stock exchanges. Bond declines. In times when traditional financial markets are exposed to unpredictable shifts, alternative assets such as alcoholic beverages or art become an appealing investment option. They offer not only the potential for financial gains but also the satisfaction of owning valuable and aesthetically pleasing works of art. Investing in art over the long term is simply good business.

The most important auctions of the past two years

The year 2023 and the beginning of 2024 were exceptionally eventful for the art market, bringing record-breaking sales and attracting collectors from around the world. Below is an overview of the most important auctions that dominated these years. Long-term investment in art is becoming increasingly popular. And auctions can be truly exciting.

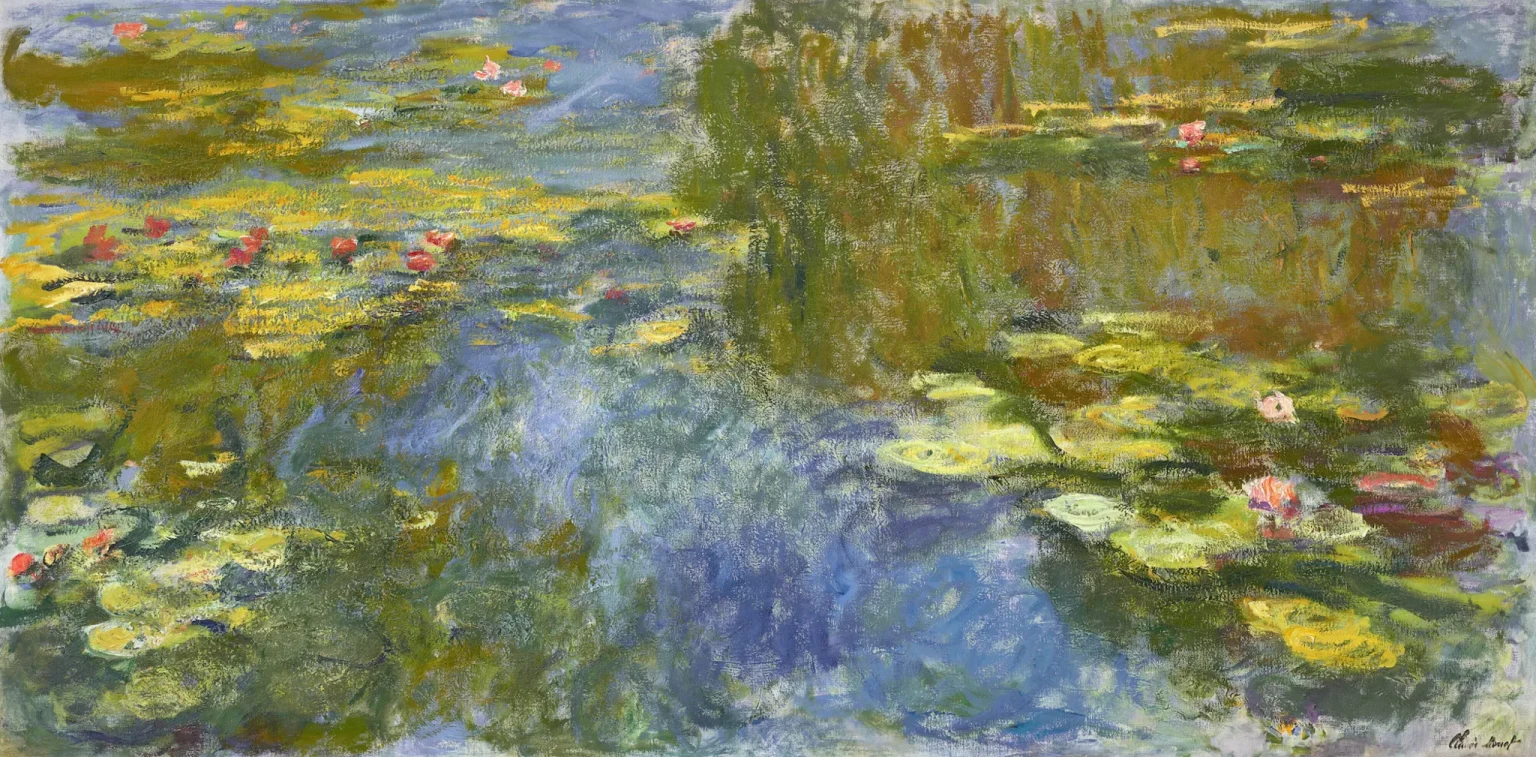

“Evening Sale” auction at Sotheby’s

One of the most significant events in the art market in 2023 was the “Evening Sale” auction at Sotheby’s in New York. Among the works up for bidding were pieces by masters such as Pablo Picasso, Claude Monet, and Mark Rothko.

photo: stationof.art

A record price was achieved by Monet’s painting “Nénuphars,” which sold for 110 million dollars.

Christie’s “Post-War and Contemporary Art”

Christie’s held the “Post-War and Contemporary Art” auction in London in November 2023, featuring works by contemporary artists.

The biggest sensation was caused by the sale of Banksy’s work titled “Love is in the Air,” which fetched £12 million, setting a new record for this artist.

Phillips “20th Century & Contemporary Art”

Phillips also played a key role in major art market events in 2023, hosting the “20th Century & Contemporary Art” auction in New York. Among the works sold were pieces by Jean-Michel Basquiat and Gerhard Richter.

photo: stationof.art

Basquiat’s painting “Untitled” from 1982 was sold for an impressive $85 million. The painting by the same artist shown above, El Gran Espectaculo (Nil), 1983, was sold for $5.2 million in 2005 and $67.1 million in 2023. This triptych, centered on the history of slavery, has seen a remarkable increase in value over the long term.

Jean-Michel Basquiat, El Gran Espectaculo (Nil), 1983. Courtesy of Christie’s Images Ltd. 2023.

Art Basel in Miami Beach

The Art Basel fair, held in December 2023 in Miami Beach, also attracted the attention of collectors and investors. It was one of the most important art fairs of the season, showcasing works by both young, promising artists and established creators. Among the most notable transactions was the sale of a Yayoi Kusama installation for $15 million.

Auction for the Benefit of the Leonardo DiCaprio Foundation

In January 2024, a unique auction was held by the Leonardo DiCaprio Foundation, aiming to raise funds for environmental protection charities. Among the works presented were pieces by artists such as Damien Hirst, Takashi Murakami, and Tracey Emin. The auction raised over 30 million dollars in total, marking a tremendous success.

Sotheby’s “Modern & Contemporary African Art”

In March 2024, the “Modern & Contemporary African Art” auction took place at Sotheby’s in London, highlighting the growing significance of African art on the global market. The most notable event was the sale of a painting by Nigerian artist Ben Enwonwu for £3 million, setting a new record for African art.

Auction “The Collection of Peggy and David Rockefeller”

The auction “The Collection of Peggy and David Rockefeller,” organized by Christie’s in May 2024, was one of the most anticipated events of the year. This collection, featuring works by artists such as Henri Matisse, Diego Rivera, and Edward Hopper, reached a total of $832 million, making it one of the most valuable private collections in auction history.

photo: stationof.art

The year 2023 and the beginning of 2024 have proven that the art market remains dynamic and full of surprises, bringing record-breaking prices and exceptional works to global auctions. The coming months promise to be just as exciting for collectors and art enthusiasts around the world.

Leave a Comment