Are bronze sculptures a good investment?

The global art market reached a value of $68.2 billion in 2024, marking a 7.5% year-on-year increase. These aren’t just numbers for collectors or galleries. At a time when inflation in Poland is outpacing forecasts and traditional bank deposits barely keep up with rising prices, people are searching for something more reliable. But are bronze sculptures a good investment? See for yourself!

Is it really worth keeping your money in the bank at 3% a year when the price of bread is rising even faster? Or buying gold, which has been swinging like a seesaw lately? Maybe it’s better to look at something that has held its value for centuries—art. Specifically, bronze sculptures.

Are bronze sculptures a good investment?

Bronze isn’t a random name for an entire era in human history. From ancient statues to the works of Rodin, this metal has always symbolized durability and prestige. Today, it’s making a comeback as a “real asset”—something tangible in a world of digital currencies and virtual investments.

In Poland, the market for bronze sculptures is attracting growing interest. It’s not just about grand masterpieces worth millions. Smaller works, local artists, even replicas of famous pieces—all of these are finding buyers. People are purchasing not only for pleasure, but also as a way to secure their capital.

This article will highlight three key things:

- What is the profit potential of bronze sculptures compared to traditional investments

- What are the risks involved and how can they be minimized

- Practical steps for someone who wants to start investing in art

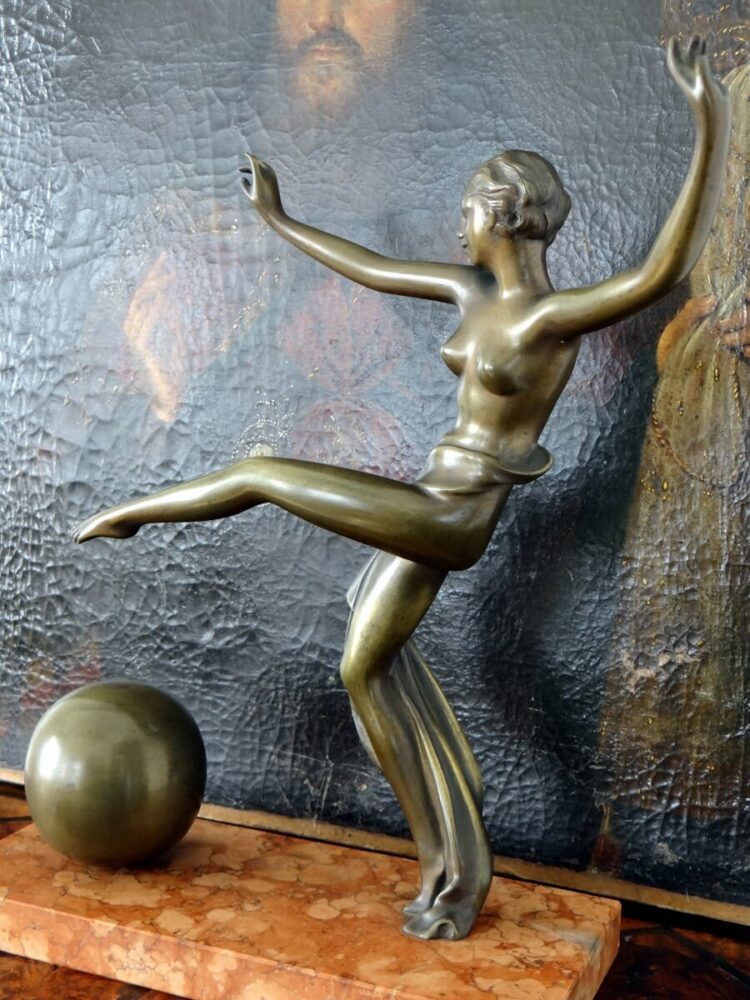

photo: artistics.com

Bronze has one clear advantage over stocks or bonds — you can touch it, display it at home, and show it to your friends. At the same time, it can deliver quite decent returns.

But is it really worth investing in bronze sculptures in 2025?

https://www.youtube.com/watch?v=bQfDUmutaOc&pp=0gcJCQYKAYcqIYzv

Profitability and risk – hard market data for 2025

Investing in art is simply buying works with the hope that their value will increase. It sounds simple, but the devil is in the details. I recently checked the art market data for 2024 and I have to admit— bronze sculptures are looking quite interesting.

| Category | Average annual return | Variability |

|---|---|---|

| Bronze sculptures | 7.2% | Average |

| Gold | 4.8% | Low |

| WIG20 | 6.1% | High |

These figures come from Artprice and Sotheby’s reports for the period 2019-2024. Of course, these are averages—some sculptures appreciate by 15% per year, while others lose value. In general, the art sector yields returns in the range of 5-10% annually, but bronze sculptures from bronze often outperform these averages.

What drives the value of a sculpture up? First—renowned artist. The name is everything. Rodin, Giacometti, Moore—their works always find buyers. Second—limited edition. The fewer copies, the higher the value of each one. And third—historical significance of the piece. Does the sculpture have an interesting backstory? Has it been exhibited in major museums?

In 2024, a copy of Rodin’s “The Thinker” sold at Christie’s auction for $11.2 million. That’s 18% more than a similar sale in 2022. This demonstrates the steady appreciation of classic works.

But to be fair—there’s significant risk involved, too.

- Counterfeits are a real problem, especially when it comes to works by famous artists.

- Storage and insurance costs can eat up a significant portion of profits

- Starting in 2025, a 23% VAT will apply to works of art in Poland, significantly increasing costs

- The art market is not very liquid – selling can take months or even years

- No guarantee of value appreciation, especially with contemporary artists

The worst part is that there’s no guarantee your piece will even find a buyer when you decide to sell it. I’ve seen cases where people held onto sculptures for years without being able to resell them.

Auction prices in 2024 showed an average increase of 8.3% for bronze sculptures compared to the previous year. Works from 1920–1960 performed particularly well. More recent pieces are much less predictable.

photo: theancienthome.com

You also have to remember the hidden costs. Insuring a sculpture will set you back about 0.5–1% of its value per year. Professional storage in a climate-controlled facility means additional expenses. And if you want to put your piece up for auction, commissions can reach up to 25% of the final price.

On the other hand, a physical work of art offers something that stocks or bonds never will. You can admire it, show it to guests. It’s not just an investment—it’s also an aesthetic pleasure.

Data from the first quarter of 2025 shows a slight market cooldown, but experts describe it as a correction after a very strong 2024. Long-term prospects remain positive.

So how can you protect yourself from these risks and maximize your chances of profit?

photo: decorative-art.co.uk

How to invest in bronze sculptures step by step

Wondering how to move from theoretical considerations to actually investing in bronze sculptures? Here’s a step-by-step action plan.

The first thing is to verify the artwork. I’ve learned this the hard way—without a proper checklist, you can easily get burned.

Certificate of authenticity signed by the artist or their heirs

Examining the patina —check if it’s natural, not artificial

Edition limit—how many copies were made (the fewer, the better)

Casting number engraved in the bronze

Provenance documentation

Condition—cracks, corrosion, missing parts

Choosing the purchase channel is a key strategic decision.

photo: europeanantiques.co.nz

Auction houses like Sotheby’s or Christie’s guarantee authenticity, but their commissions can reach 25%. Pros: professional expertise, money-back guarantee. Cons: high prices, competition from collectors worldwide.

Polish galleries—Antikon, TanieAntyki—offer better prices and room for negotiation. Sometimes you can find a real gem there. But the expertise may be weaker, so you need to know more yourself.

OLX and similar platforms? Risky, but there are occasional bargains. I once saw a genuine Dunikowski there for 3,000 PLN. Someone didn’t know what they had.

| Position | %/amount | Comment |

|---|---|---|

| Auction house commission | up to 25% | Paid by the buyer additionally |

| VAT | 23% | From the total amount with margin |

| Transport | 100-300 PLN | Depending on the distance |

| Annual insurance | 1-2% of the value | Mandatory for storage |

| Maintenance | 200-500 PLN | Every 2-3 years |

For a sculpture priced at 10,000 PLN, your actual cost is around 13,800 PLN plus ongoing expenses.

Storage — this is where most people make mistakes. Keep humidity between 40-55%, maintain a constant temperature (ideally 18-20 degrees Celsius). Never use chlorine-based products! And please — don’t polish bronze. Patina isn’t dirt; it’s a natural protective layer. Remove it, and you’ll lose half the sculpture’s value.

Keep the piece away from radiators and windows. Dust it with a dry, soft cloth. Once a year, you can gently clean it with distilled water.

Exit strategy? Plan it from the start. Bronzes are easiest to sell after 5-10 years, when the market has forgotten the last major transaction involving that artist.

With these tools, you’re ready to act — but should you?

photo: bronze-sculpture-art.com

See if this investment is right for you – next steps

After considering all aspects of investing in bronze sculptures, it’s time to decide whether this market is suitable for a particular investor.

Before making a first purchase, it’s worth honestly answering a few key questions:

| Question | Yes | No |

|---|---|---|

| Do you have at least 50,000 PLN in available funds? | ✓ | ✗ |

| Can you wait 5-10 years for a return? | ✓ | ✗ |

| Are you interested in art beyond its financial aspect? | ✓ | ✗ |

| Do you have a place to store artworks? | ✓ | ✗ |

| Do you accept the risk of illiquidity? | ✓ | ✗ |

If most of your answers are “yes,” it’s worth taking a look at the trends that will shape this market in the coming years.

photo: deconamic.com

First, NFT certification for physical sculptures. It may sound like science fiction, but some galleries are already experimenting with tokens that confirm the authenticity of artworks. This could significantly simplify trading and verification.

The second trend is the surge of interest in Asian countries. Chinese and Japanese collectors are discovering European bronze sculptures—forecasts predict a 10% annual increase in value in the premium segment by 2030.

The third factor is growing environmental awareness. Bronze artworks, being durable and recyclable, are gaining popularity among younger investors.

For those looking to start their adventure in this market, here are three concrete steps for the coming month:

- Sign up for an online course on art history or artwork appraisal – an investment of 200-500 PLN in knowledge will pay off many times over

- Set a budget that accounts for no more than 10% of your entire investment portfolio and do not exceed it for the first two years.

- Book a consultation with a certified art appraiser – the cost of 300-800 PLN per hour is a small price to pay for a professional assessment of your first purchase

Investing in bronze sculptures is not just a numbers game—it’s about building a relationship with art that will endure for generations.

Mark

lifestyle & investment editor

Luxury Blog

Leave a Comment