Property prices in Dubai, check how much they cost

In 2025, the real estate market in Dubai reached a value of around 917 billion dirhams, with as much as 87% of transactions being cash purchases. Impressive numbers, right? For buyers, it’s crucial to understand that 1 AED is roughly 0.25 EUR, or the other way around — 1 EUR is about 4 AED. This relatively stable exchange rate makes budget planning quite predictable. Today, I’ll try to describe what property prices in Dubai look like.

Since 2002, foreigners have been able to buy property outright in designated freehold zones. This opened the market to investors from all over the world, including from Europe. And today, there’s a noticeable increase in interest in this form of capital investment. So I decided to explore the market for you even more!

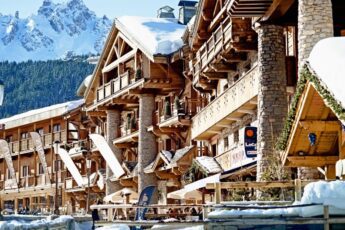

photo: famproperties.com

Real estate prices in Dubai – my analysis

Dubai is now a city with a population of over 3.8 million residents and record-breaking tourism in 2025. The demand is driven mainly by a young demographic and a focus on development. And clearly, for many years, significant investments have been made here to ensure the city stands as a tourism icon.

Importantly, after the frenzied boom of 2021-2025, the market is entering a phase of moderation. The growing supply of apartments is starting to stabilize prices, so we are no longer seeing skyrocketing increases. This is good news for buyers seeking reasonable valuations rather than speculative fever.

photo: economymiddleeast.com

Price ranges, types, and standard

Let’s start with the basics: 1 AED is approximately 0.25 EUR. This rate fluctuates slightly, but it’s great for quick calculations. And now for the specific numbers, since that’s probably what interests you most.

Current price range in euros

Studios usually cost between €105,000 and €198,000 ( equivalent to AED 450-850k), although standard models tend to fall within the lower range. One-bedroom apartments range from €209,000 to €372,000 (AED 900k-1.6m), while two-bedroom units start at around €349,000 and can reach up to €651,000 (AED 1.5-2.8m). Villas and townhouses? Here, prices start at a minimum of €511,000, with the upper limit easily reaching €1.86 million and above (AED 2.2-8m+). Luxury locations like Palm Jumeirah can exceed €7.5 million (AED 30m+), so the price range is truly wide.

The price per square meter for apartments ranges from ~€2,100 to €7,800, with the median around €4,900 (roughly AED 19,000). The average transaction value exceeds ~AED 2.6 million, which is about €650,000.

photo: dxbinteract.com

What affects the price?

Off-plan properties (under construction) often require a payment of 20-60% of the value according to a schedule, which gives flexibility. Ready-to-move-in apartments are usually more expensive per m², but you can rent them out or move in immediately. Sea view or Burj Khalifa view? Expect to pay at least several percent more. The floor matters too—higher means pricier.

Example: for €300,000 you can buy a decent 1-bedroom (about 55-70 m²) with good standards, while for €150,000 you’ll get a studio (maybe 35-45 m²) in a decent location. Size and finish make a difference.

photo: uniqueproperties.ae

Comparison €/m² in key districts

Location in Dubai is key. Price differences between districts are significant and directly affect how much you’ll actually pay and what rental return you can expect.

Here are approximate rates at the beginning of 2026:

| District | €/m² | ROI (rental) | For whom |

|---|---|---|---|

| JVC | €2,100–€2,500 | 7-9% | Investors seeking profit |

| Dubai Marina | €5,000+ | 5-6% | Expats, young professionals |

| Downtown | €6,500–€11,500 | 4-5% | Prestige, views of the Burj Khalifa |

| Palm Jumeirah | €7,500+ | 4-5% | Luxury, villas for the wealthy |

The differences are truly significant. Take this example: a 60 m² apartment in JVC costs around €135,000 (at €2,250/m²). The same 60 m² in Downtown? Already €480,000 (with an average of €8,000/m²). That’s more than three times the price, and the ROI in JVC is twice as high.

photo: wurarealestate.com

Freehold zones and the nature of the location

All the districts listed are freehold zones, meaning foreigners can buy property without restrictions. Dubai Marina is a hub for expats, with marinas, restaurants, and a vibrant city atmosphere. Downtown offers views and prestige, but you pay a premium for it. JVC (Jumeirah Village Circle) is a quieter, family-friendly area, which means lower prices and better ROI. Palm Jumeirah is in a league of its own, mainly featuring villas and ultra-luxury apartments.

Keep in mind these are indicative rates. Actual prices depend on the view, floor, developer, and finishing standard. However, the market is so vast that everyone can find something for themselves!

Fees, maintenance, and visa

The price of an apartment or villa is only part of the story. In reality, you will pay more, and the difference can be surprising.

photo: kaizenams.com

Fees when purchasing step by step

The largest item is the DLD (Dubai Land Department fee), which amounts to 4% of the property price. For a purchase of €300,000, that’s €12,000. On top of that, there’s the agent’s commission, usually around 2% plus VAT, so in this example, another €6,000–€6,300. If you’re taking out a mortgage, you’ll also need to pay for mortgage registration (from 0.25% to 0.5% of the loan value) and a few smaller administrative fees. Total? Around 6–7% of the purchase price goes toward transaction costs.

And this is exactly where the difference lies compared to many European markets. In Dubai, there is no property tax or rental income tax. You pay once at the time of purchase, and then only for maintenance.

photo: liminastudios.com

Visa

Annual costs are usually €2,000–€5,000, depending on the building’s standard and available amenities (pool, gym, security). The higher the standard, the higher the service charge.

If you’re considering a residency visa, the thresholds are specific. A property worth at least 750,000 AED (about €190,000) grants a shorter permit, while the 2,000,000 AED threshold (roughly €515,000) opens the way to a 10-year Golden Visa. The value is calculated based on the purchase price, not the current market valuation.

For an investment of €300,000, the total initial cost (price + fees) will be around €320,000. Then, annual maintenance costs apply, but without property or income taxes.

Scenarios for the future

photo: cbnme.com

To understand where we are now, it’s worth going back to 2014. Back then, the average price per square foot was around 1,003 AED. Then came a correction, and in 2020 we dropped to about 894 AED/sqft (the effect of the pandemic and previous oversupply). And from that moment, things really started to happen.

We closed 2024 in the range of 1,524–1,597 AED/sqft, depending on the data source. For 2025, forecasts point to 1,625 AED/sqft, and some scenarios see 2026 above 1,800 AED/sqft. Sounds like a rocket, but beware: the growth rate is already slowing down. We’re entering a phase of moderation, not further euphoria.

Sales volume and market structure

Scale? In 2025, we expect around 270,000 transactions with a total value of 917 billion AED. The first quarter of 2025 alone brought ~42,000 transactions (approx. 114 billion AED). Interestingly, 60-70% are off-plan purchases, and 87% of buyers pay in cash. This shows how solid the market’s foundation is, although the high share of off-plan also means greater sensitivity to project delays.

On the supply side: in 2025, ~48,000 new units are expected to be delivered, and in 2026 as many as ~72,000, with Q1 2025 alone providing ~9,400 units. Dubai’s population now exceeds 3.8 million, plus tourism (over 17 million in 2024), so demand is there. The only question is whether supply will start to outpace it.

Forecasts

Here’s where it gets interesting. For villas and the premium segment, most analysts predict an increase of +5-8% in 2026. Apartments in the mid-range segment? Fitch and other cautious experts warn of a possible correction of around 10-15%, mainly due to an oversupply of off-plan properties and a growing number of deliveries. Rents are rising in the short term ( +6-13%), so buy-to-let investors have a cushion, but in 2026-2027, price pressure may go the other way.

So what does this mean? If you’re looking at luxury and villas, the outlook appears stable. Apartments? You need to be careful with timing.

How to wisely read the Dubai market?

photo: elysian.com

The Dubai market is not just about hard data; it’s also about the context that determines whether a given price is a bargain or a trap. One square meter in Marina may cost similarly to Downtown, but the rental potential, metro access, and development prospects of the area create a completely different investment story. Average prices in euros provide a reference point, but the real value lies in the details that developers rarely mention in their sales brochures.

That’s why, when buying in Dubai, it’s worth looking beyond just the numbers on the listing page. Location, the maturity of the district, the quality of the developer, and the actual maintenance costs often matter more than the purchase price itself.

And it’s this ability to read between the lines that separates a successful investment from disappointment. I already own two properties in Dubai and I honestly recommend this region to you!

Stev

premium real estate and golf enthusiast

Luxury Blog editorial team

Leave a Comment